Participant Wise Open Interest - 30th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

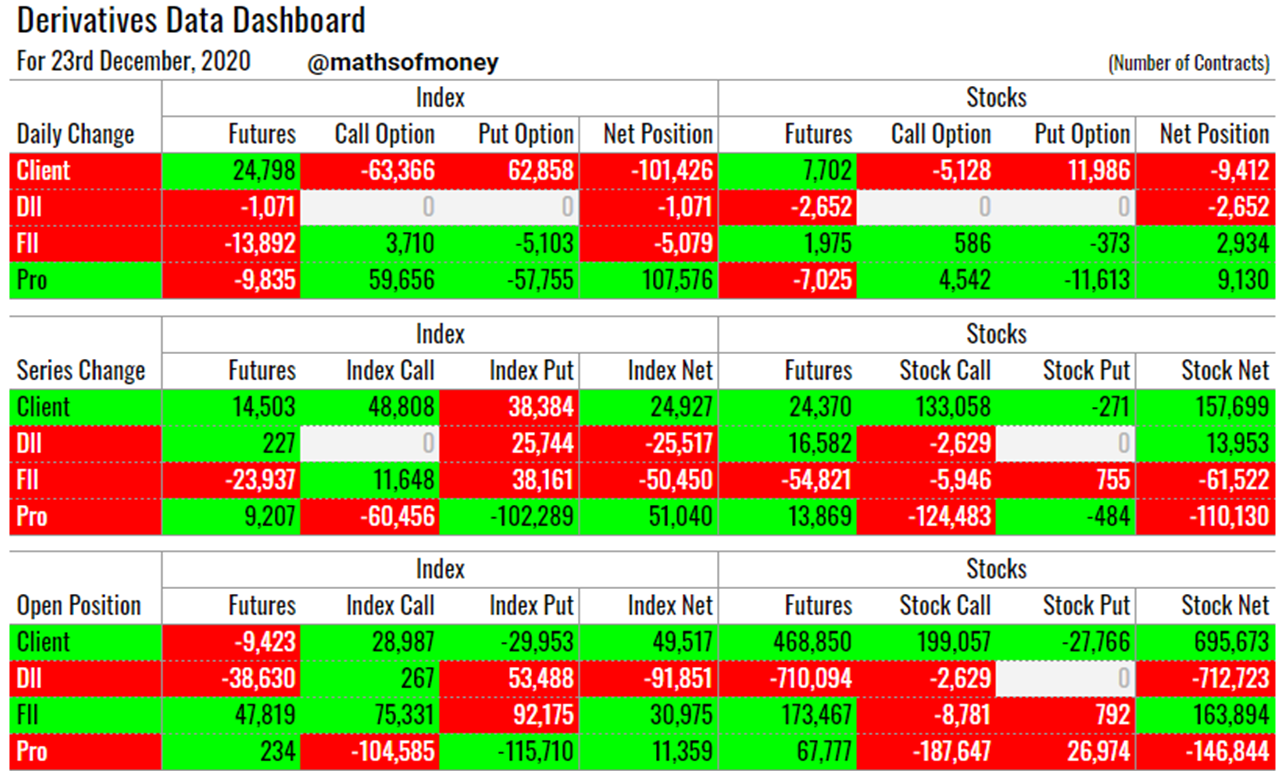

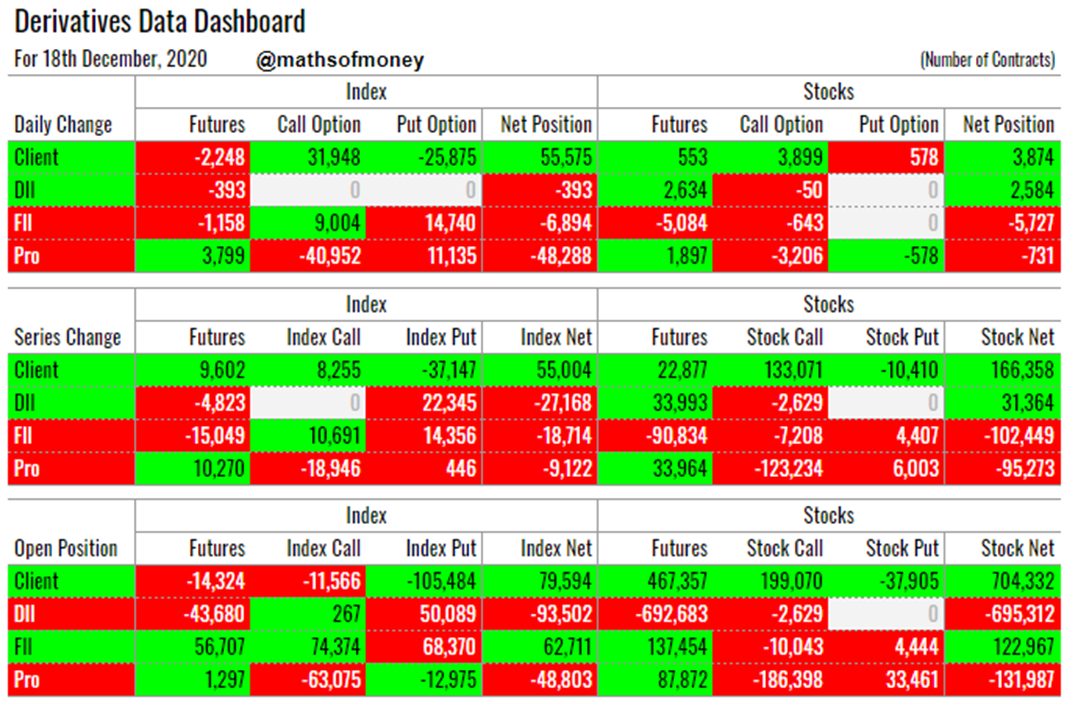

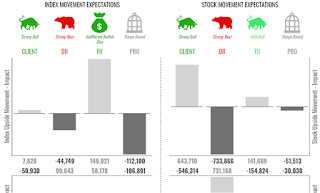

Participant Wise Open Position Analysis - 30th December Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants. Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market: India VIX remained range bound at 21. Brent Oil prices remain buoyant above 51 but there is no run away action as yet Dollar Index (DXY) keeps struggling below 90. This was expected in the light of thin volumes and approval of Brexit Deal by UK Parliament Nifty daily RSI climbed back above 70, however, weekly RSI is close to 80 Yesterday's Derivative Data Analysis - For Comparison 29th Decemb