Participant Wise Open Position - 22nd December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 22nd December

Welcome to the daily analysis of Participant Wise Open Position Derivative Data including day end participant wise open positions, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we get into the derivatives data for the day please bear in mind that India VIX (volatility index for Nifty) today jumped over 24 and closed around 22. This is an indication of increasing volatility and also change in general direction of the market.

Yesterday's Derivative Data Analysis - For Comparison

21st December - Dashboard

Today's Participant Wise Open Position

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients have unwound almost half of their net long position in index today by going net long on 120k contracts.

- In spite of this, retail investors remain net buyers of index for December series by 126k contracts. Clients also carry highest long position open interest in index of 150k contracts.

- Even after today's unwinding of 16k long positions in stock contracts, clients continue to carry higher long position in stock contracts of 705k contracts. This continues to support thesis of impending correction.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII's have sold stock futures worth 11k contracts taking their total short position in stocks to 710k.

- Once again a muted day for index action by DII with net buy in index futures of 4k contracts.

- All in all, last few days DII's stance has been very consistent with carrying their short positions both in Index as well as in Stocks. We can presume these as their hedge / profit booking technique against their cash market holdings and somewhat redemption amounts for investors booking profits with rising volatility.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII have been mildly bullish for the day with net long built-up in index (15k) as well as stocks (19k).

- Inspite of today's long trades, FII remain net sellers in Index (45k) and stocks (65k) both for December series .

- Net open position of FII remains subdued for Nifty and Bank Nifty at only 36k contracts which comprises of both long in index futures as well as long in index call options. Long positions in index futures is fully covered by long positions in index put options as well. All in all, FII now carries a safe long bet.

- FII's open interest is exposed for stocks which comprises of 161k long positions in stock futures.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- With 19k long in index call options and 82k short in index put options, PRO have taken bullish stance in Nifty and Bank Nifty for today.

- Inspite of such aggressive bullish trades for the day, they still carry net short position in index contracts by way of selling of index call option. This indicates the trades by PRO today were more pointed towards weekly expiry and the overall bearish stance continue.

- PRO's trade in stocks were also bullish for the day but by way of selling of 9k stock put options. However they continue to carry 156k short positions in stocks which is primarily by way of selling of stock call options. A ploy to take advantage of euphoria reflected in call pricing. A strong bearish indicator.

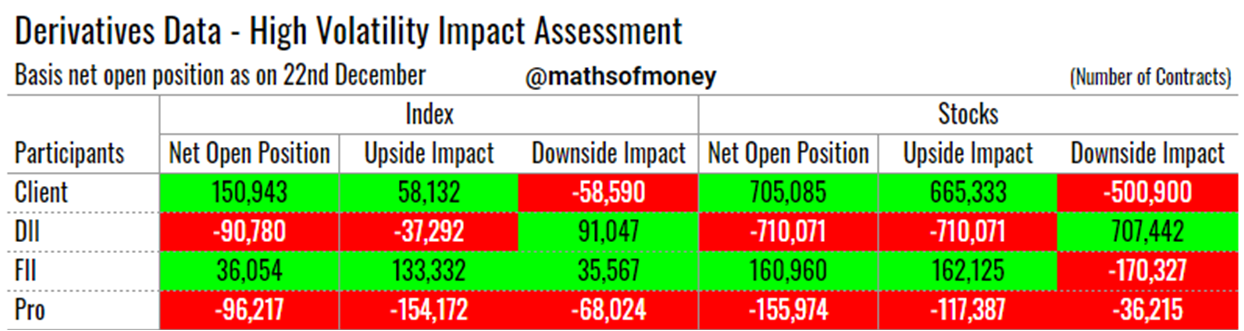

High Volatility Impact Assessment for Open Positions in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility heat map:

Index Volatility Impact Assessment

- FII remain gainers irrespective of movement direction in index.

- PRO have set their position for a range bound index, however, much lower exposure in case the range is broken down.

- DII is set to gain much more in case of break down in index and a little in case of break up.

- Clients have single directional position - Max gain in case of up move and Max pain in case of down move. A strong bear case.

Stocks Volatility Impact Assessment

- Retail investors happens to bleed the most in case stocks move downwards and also to gain the most in case stocks move up. A strong bear case.

- PRO have placed their bets in stocks also for a range bound movement, again, with much lower impact in case of breakdown of the range.

- FII & DII carry almost mirrored impact in case of high volatility movement in stocks with FII being bullish and DII being bearish.

Comments

Post a Comment