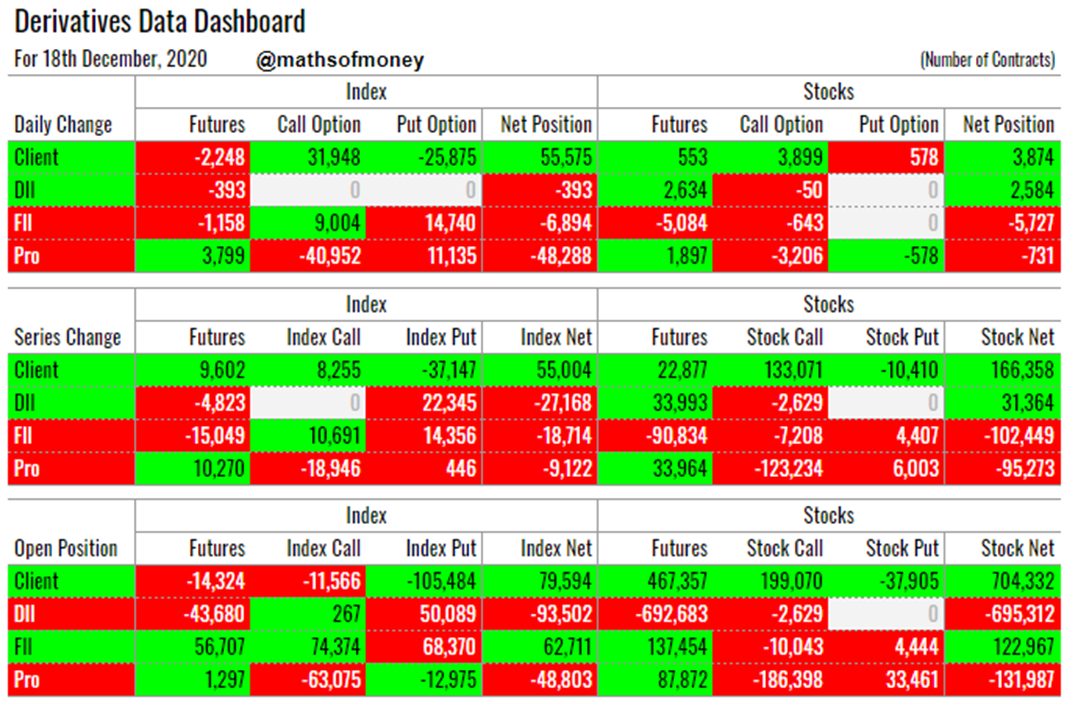

Participant Wise Open Position - 18th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 18th December

Welcome to the daily analysis of Participant Wise Open Position Derivative Data including day end participant wise open positions, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Yesterday's Derivative Data Analysis - For Comparison

17th December - Dashboard

Today's Participant Wise Open Position

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) have gone net long in Index (55k) as well as in Stock contracts (4k) for today.

- Out of 55k long positions created in Index, 26k was by way of selling of put options which were bought by FII and PRO. So as long as seeing index at its support line - FII and Pro disagree with Clients. Also, the bet that clients carry is of maximum loss and minimum gain type (selling of option contract) where as the situation is reverse for FII and PRO. This is one of the biggest bearish indicator for the day.

- Clients now carry net long position (80k) in Index Contracts which comprises selling of (91k) Index Put Options and Index Call Options (11k). This set up is expecting range bound movement in Nifty as well as in Bank Nifty with bullish bias.

- Clients net trades for the day in stocks reflects cautious participation in the bull run by creating net long position in stock call options worth 4k contracts.

- Net open position of Clients (Retail) is 704k stock contracts long which includes mainly stock futures long of 467k contracts and add to stock put options short of 38k. This composition of long built up indicates bullish complacency - yet another bearish indication.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- While DII only made a very small trade in Index by way of selling of Index Futures, their stock trade also is limited to unwinding of their carries short position in stocks by creating long position in 3k stock futures.

- DII's net trades for December series also is unwinding of their carried short position in stocks (31k) by way of buying of stock futures. However, for Index they have built up on their November month short position primarily by way of buying of index put options.

- However, DII's net open position at the end of the day shows aggressive and fully exposed short position in stock contracts of 695k. Where as semi exposed short position in Index contracts of 93k. This means their position is nothing but hedge for their portfolio since this position was carried from Novemebr Series. It is clear that DII have not participated in bull run of December for their open position which is approximately 55k Crores and around 4-5% of total equity AUM with MF's. This means - DII are still to book profits.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII has been net seller of Index as well as Stock for the day.

- Most interesting part is FII's open position of 62k contracts long in index comprises entirely of long in index call options. This shows that for today's net position FII has limited downside risk and full participation in any upside move in Nifty as well as in Bank Nifty.

- With todays sell of 6k stock futures, FII have booked profit in 102k stock contracts in December. This again is an indicator of distribution of stocks to retail investors at higher prices as clients are net buyers of 166k stock contracts in December.

- Net open position in stock contracts by FII is 123k which is lowest since May 2020. This means FII's long term bullish view on the market which lasted for last six months is fading.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Pro's are biggest sellers in Index contracts (48k) for the day with 41k being shorts created in Index Call Options. Also, their net open position for index call options is short by 63k contracts. These show PRO's conviction that Nifty and Bank Nifty have made the top.

- Pro have also covered half of their short position in index put options which means they do not see index finding support near by in case it starts to fall.

- While their net positions in stocks is minimal, it also includes 3k shorts for stock call options. Most interestingly PRO have sold, 123k stock call options for December Series and 187k net short position in stock call options again confirm their view that there shall be no new highs in stocks for December series.

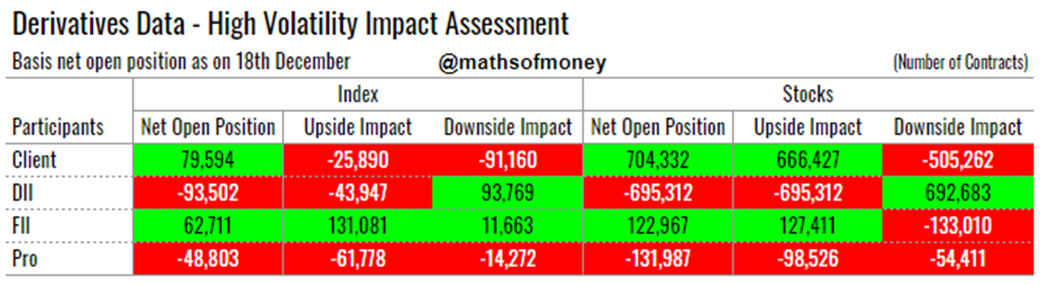

High Volatility Impact Assessment for Open Positions in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility heat map:

Index Volatility Impact Assessment

- FII stands to gain even in the downside of Index. This is the indication that they have used recent movement in index to keep hedging against their long positions.

- Clients, in trap, with losses in either side movement. Highest impact being in the downside. Complacency for upside movement in the market with retail investors is evident from this.

- DII remains the biggest beneficiary of a steep downside movement, and only half the risk exposure in case of an upside move.

Stocks Volatility Impact Assessment

- FII and DII all three have balanced composition of their open position in stocks - risk and reward almost in the same range for movement in either direction.

- PRO carries positions which shall bleed in case of steep movement either side (range bound expectation), however, more so in case of upside move in stocks.

- Clients remain single largest gainers in case stocks go up and also biggest loses in case stocks go down. The question is shall institutions take the market up to make retail investors earn?

Comments

Post a Comment