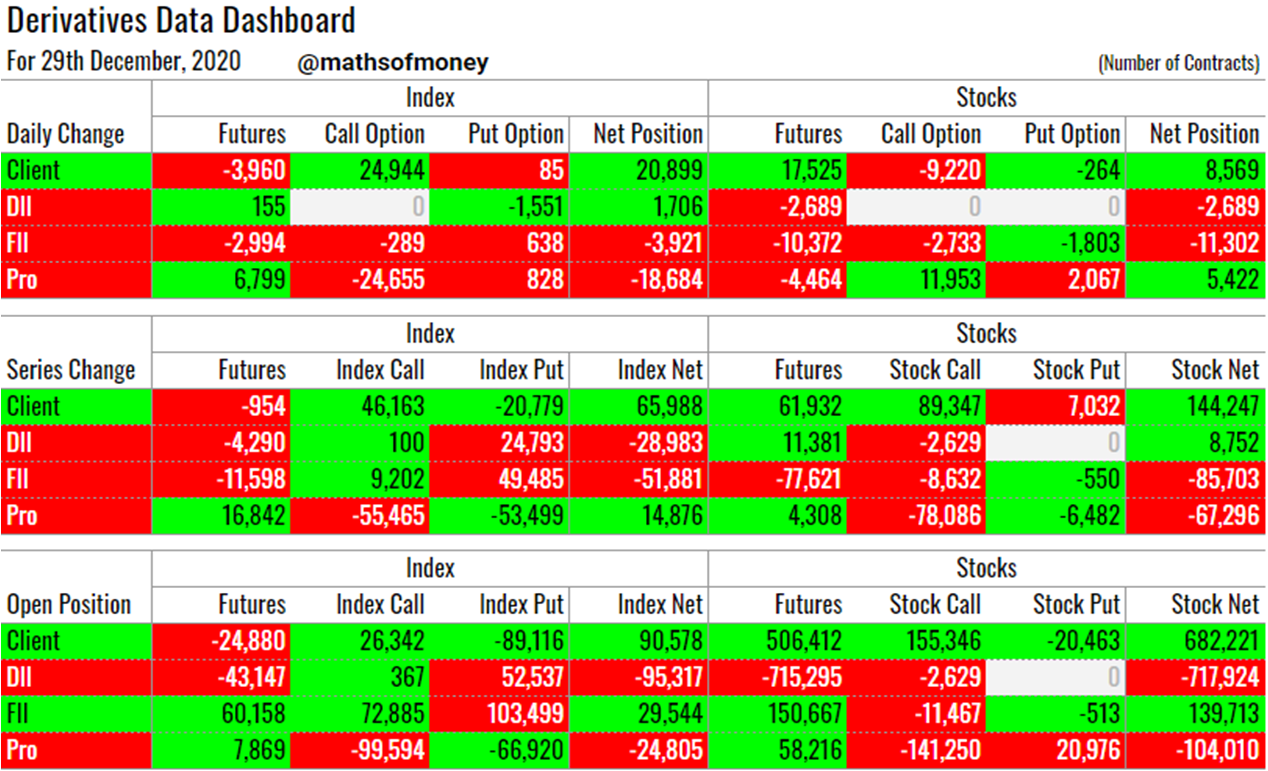

Participant Wise Open Interest - 29th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 29th December

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX although couldn't survive above 21 on intraday basis, closed near 21 inspite of market remaining in green the full day.

- Brent Oil rises by more than 1%, waiting to confirm the break out and fly to 65$ levels.

- Dollar Index (DXY) had break down below 90, this ensures continued liquidity flow into emerging markets.

- Nifty daily RSI started showing divergence in shorter time frames.

- Nifty had a negative breadth (28 declines) in spite of registering all time high today, also even though there was a pull back in Nifty, it couldn't breach day high.

Yesterday's Derivative Data Analysis - For Comparison

28th December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) have created 25k long positions in index call options today which were shorted by PRO - a close scrutiny of option chain shows maximum new open interest in index call options was for at the money and just in the money contracts (13,900-14,100)

- Retail investors have also bought 18k stock futures from all the rest of the participants today. Nifty coincidentally stayed near all time high but showed negative breadth which is confirmation of distribution.

- With today's all round bullish trades, clients now carry highest bullish positions both in index as well as in stocks at the end of the day.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII remained muted again with hedging some more of their cash market position by way of sell in stock futures and booked profit in some of their existing longs in index put options - possibly during the fall in the first half.

- On net open position basis, DII remain with highest bearish bets both on index and stocks.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII's have sold their 1ok longs in stock futures to retail investors today and also added 3k shorts in stock call options while adding 4k short position in index as well.

- Now with net short of 11k stock call options and 103k longs in index put options just two days ahead of monthly expiry suggests distribution might be reaching its end and we might see a reversal in trend soon.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- After selling 25k index call options to retail investors (Clients) today, PRO are now OFFICIAL WRITERS OF INDEX CALLS (100k) and STOCK CALLS (141k) for this series where as Clients are OFFICIAL WRITERS OF INDEX PUTS (89k) and STOCK PUTS (20k). The irony here is evident.

- In spite of index touching all time high, PRO added their shorts in call options instead of covering the position. This shows their conviction that the index is topping out. Similar reading can be drawn by net short of 141k call options in stocks.

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- Clients are now strong bulls for Nifty and Bank Nifty that too with no gain in upwards movement of index and max pain in case of fall - This is yet another strong bear case.

- FIIs remain only gainer in case index moves up. However, even in case of fall they do tend to make profits.

- DII stand to lose upside for their hedged positions and make double that in case of fall in index.

- PRO are still playing for range bound movement in Nifty and Bank Nifty at least for December series.

Stocks Volatility Impact Assessment

- Clients remain biggest gainers of upside movement in stocks and biggest losers in case of fall - a strong bull set up

- FII, although, are second biggest gainers of rise in stock prices they lag clients in long positions by almost a factor of 4.5 - a mild bull case

- DII give up gains of their hedged position in case there is a rise and make equal amount in case of fall - a strong bear case

- PRO expect markets to remain range bound, however they bleed almost 2x in case of breakout as against breakdown - range bound expectations with bearish bias

For tomorrow possible scenarios are:

1. FII vs PRO : Index continues to march higher and FIIs look to profit from their net long positions in index call options and force PRO to cover their shorts and in turn give up full premium of their longs in index put options; or

2. Retail vs The Rest : A sharp fall for FII's to book profits in longs in index put options (103k) and short in stock call options (11k) forcing retail investors to cover shorts in index putoptions (89k), stock put options (20k) and trigger unwinding of longs in stock futures (506k) contracts.

Comments

Post a Comment