NIfty FMCG - CNXFMCG - Long Term Analysis

FMCG Theme

Consumption is the theme which has seen multi fold rise both in terms of market and market cap over last decade in India. FMCG with increasing infrastructure and logistics has been able to tap into the Rural demand of India to experience exponential growth in market size. This has been duly reflected in price movement of Nifty FMCG (CNX FMCG - used interchangably for SEO Purposes).

Nifty FMCG - Monthly Price Movement

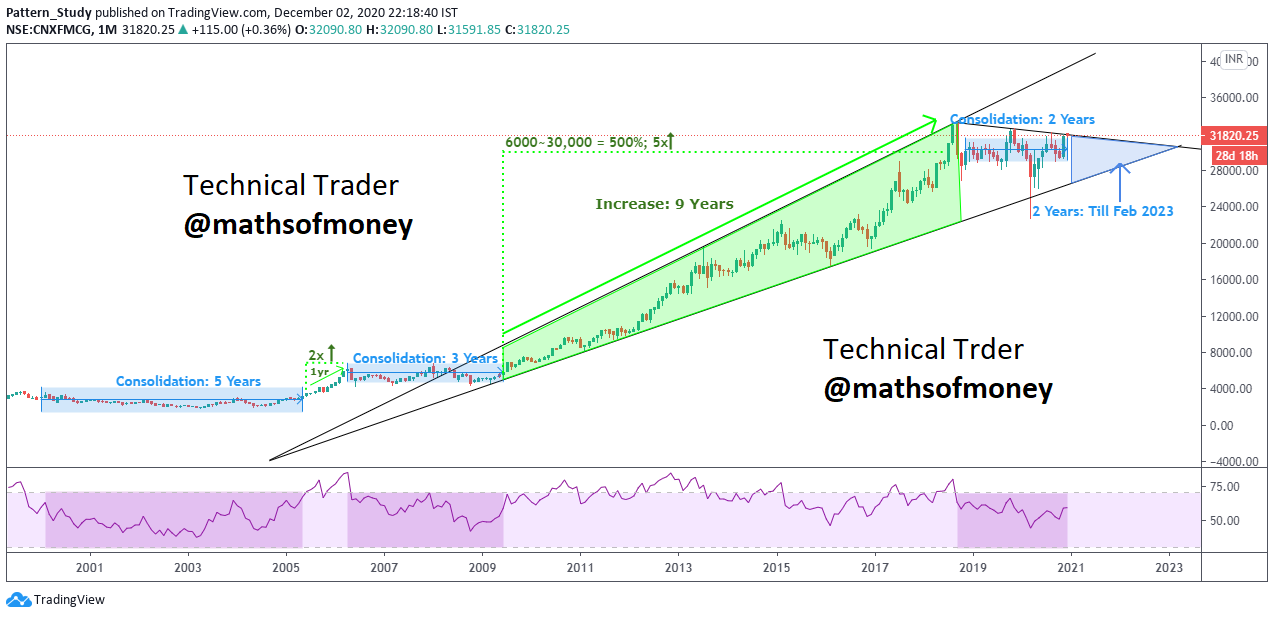

Let us begin with understanding monthly chart for CNX FMCG over last two decades to study the price action:

Nifty FMCG has risen by about ten times over last two decades, however, this increase has not been lateral, with two consolidation periods totaling eight years, the major rise has been during last nine years since late 2009 which was primarily fueled by the two heavy weights of CNX FMCG - Hindustan Unilever and ITC (Please bear in mind that the index gets rebalanced every six months so this is more of a continuing high weight age consideration).

Upward Rising Wedge

The upmove which delivered 500% gain in the index has been in a rising wedge with very clear support and resistance which it had been respecting on monthly levels untill COVID period of March-20. Even during these period, there was never a followup candle on downside of the wedge and hence, it is safe to say that Nifty FMCG has respected the upward rising wedge even during the COVID period. Also, since early 2019 CNX FMCG had already started its sideways movement and got into its third consolidation phase inside of the wedge pattern. This consolidation has been going on since last two years now.

From here on, there are three distinct possibilities for CNX FMCG to follow:

- Consolidation: Ongoing consolidation could continue until the index meets the bottom of the wedge through the sideways movement (like it followed back in 2008-2009 - Second consolidation phase), without any sharp movements either side. This possibility means the index shall reach the support line of wedge as late as February 2023. That means two more years of consolidation before Nifty FMCG either takes support or breaks down for clearer further direction.

- Correction: Another possibility is for the index to have sharp correction from present levels, reach the bottom of the wedge much ahead may be early 2021 and resume upwards journey from there. This would need a sharp correction (not just profit booking) in Nifty.

- Breakout: The third and more bullish possibility is for CNX FMCG to take a breakout at the resistance line near which is has closed in November 2020 and continue the upwards movement until it tests the top of the wedge again.

To understand which possibility is more likely pan out we need to analyse the current constituents of CNX FMCG to see what their level looks like. However, there is an additional indicator, which has empirically held strongly for Nifty FMCG, which we can depend on to chart out and understand more likely scenario out of the three.

Relative Strength Index - RSI - CNX FMCG

I have highlighted all three consolidation phases of Nifty FMCG on its monthly RSI showing at the bottom of the chart. There is a clear indication that whenever Nifty FMCG has been in consolidation phase, the RSI has never crossed over 70. Now we all know that relative strength index is more meaningful over longer time periods meaning an RSI reading of a 1 day chart is more reliable than a 15 minutes chart. Here we are talking about consistent behavior of RSI on monthly chart basis for a major sector index over two decades period. This is as strong a reading as it can ever get from technical indicators. Having established the significance of RSI, the reading says it has stayed well below 70 since early 2019 and the most recent support of RSI was at the levels of 50 during October-20. As long as RSI stays above 50 and below 70, we can presume it is more likely to consolidate and on breaking of the either side we can see how index gets placed in the wedge to see which of the three scenario is getting activated.

As a followup of this analysis, I shall also include long term study on few heavy weights of Nifty FMCG to see which stocks could see the major chunk of price action that CNX FMCG is going to deliver.

Comments

Post a Comment