Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Nifty and Stocks - Daily Analysis - 16th December

Derivative Data Dashboard - 16th December

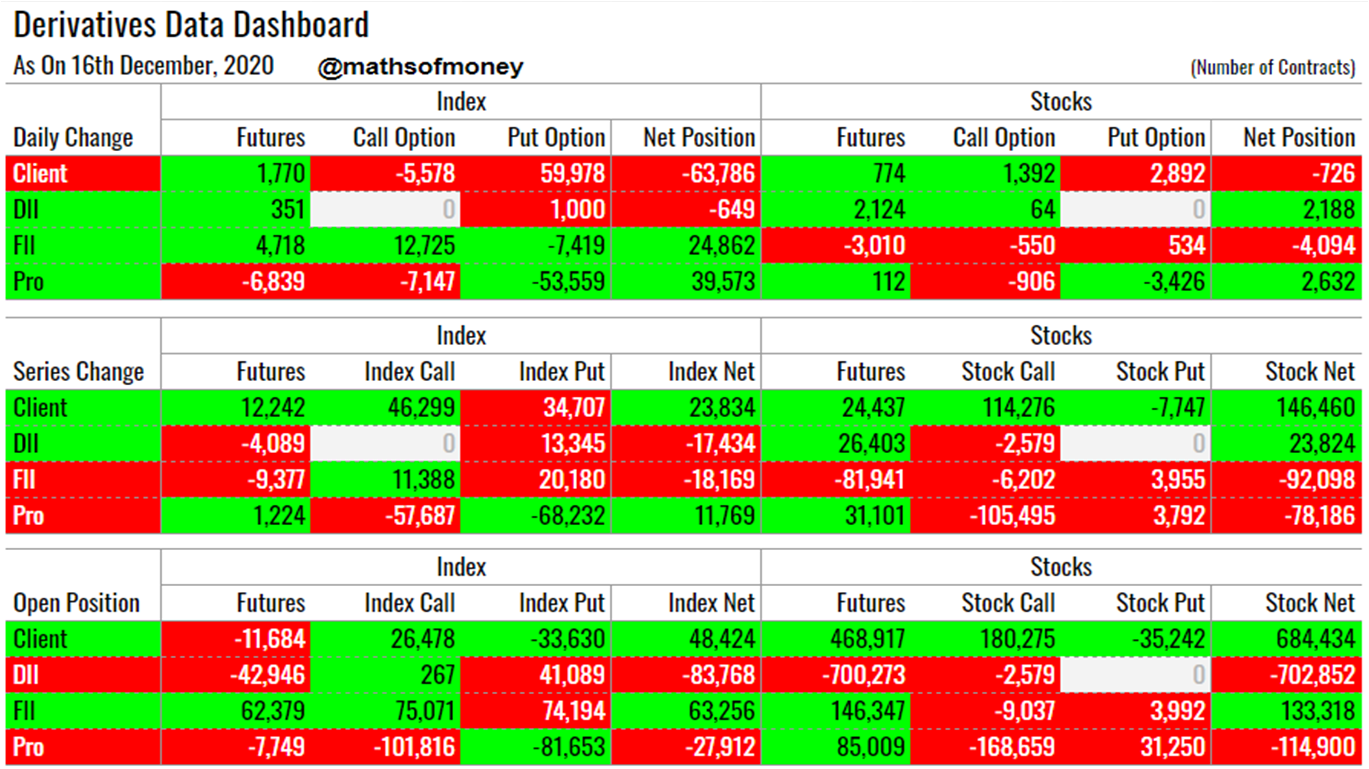

In depth analysis of Derivative Data including open positions, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in futures, call options and put options for each category of participants.

Technical Trader Derivatives Data

Yesterday's Derivative Data Analysis - For Comparison

Here are key highlights for today:

Daily Change in Index and Stocks Derivatives

(Net trades executed today by each participant - Client, FII, DII and Pro):

- Today's major shift in positions is only in index contracts while positions in stocks have been mostly muted. This is quite understandable considering its day before weekly expiry.

- Clients (Retail Investors) are net sellers of 64k index contracts which was primarily by way of buying in Put Options. This is unwinding of huge short positions in Index Put Options retail was carrying till yesterday which reduces their maximum pain exposure in case of market fall.

- Pro are the largest long position creators for the day in index contracts of 40k. Interestingly they are net sellers of index call options (7k) and index put options (54k) both. This is to suggest they are playing for the market to remain range bound. Interestingly though, Pro have also sold future index contracts (7k) which almost eliminates all long positions in index futures they created since the beginning of December series.

- FII continued to buy call options (12k), sold put options (7k) and also sold future index contracts (5k) taking net sell position of 25k in index contracts without any internal hedge. The same builtup was followed yesterday. The question remains is this weekly expiry play for platform for next bull run. We will get answer to this only from tomorrow's data as all weekly positions shall be shrug off with a more clearer direction of FII for the market.

- FII played an absolute contrast trade for the day in stock contracts with much lower net sell position of 4k contracts without any internal hedge. This was bought by DII and Pro equally.

Series Change in Index and Stocks Derivatives

(Net trades executed since the beginning of futures monthly series by each participant - Client, FII, DII and Pro):

- Major divergence in series change is seen in Pro positions. They have turned net buyers in index contracts (12k) while continuing to be net sellers in stock contracts (78k) for December series. Yet another indication of consolidation of Nifty between 13400-13600 is set to be broken on the upside. This is assuming net sell position (74k) of Pro in stock call options is just to hedge their cash holdings.

- However, Pro are net sellers of index call options and index put options for the series which might also indicate that India VIX could subside for the rest of the month and market may continue to remain range bound until a clearer direction emerges. Again this divergence shall be tested as we get data for tomorrow post weekly expiry.

- DII and FII continue to be bearish for the series both in index as well as in stock contracts.

Open Positions in Index and Stocks Derivatives

(Open position at the end of today of each participant - Client, FII, DII and Pro):

- Clients carry 48k contracts net short for index and the nature is of maximum loss in case of downside movement while limited gain in case market moves on the upside. This is more or less a sham long position.

- Clients net long open position in stock contracts continues to be the hanging sword with the composition which would result in maximum loss in case of downside movement and maximum gain in case of upside movement. This is the highest impact composition.

- DII continues to carry net short positions in index as well as stock and both the positions are unhedged shorts which will result in full loss in case of upside whereas full gain in case of downside.

- Pro,even though carries net short position in index contracts the nature still reflects range bound movement because they have net short in call options ans well put options.

- Pro has net sell position in stock call options which mean they are either simply hedged against their cash holdings which is executed when they are playing for the market to be stagnant at this stage.

- FII's net long positions both in index and stock are simply by way of buying of future contracts.

In summary, the data is typically Wednesday data which should be read in conjunction with tomorrow's data to understand whether its a continuation of consolidation or readiness for break out.

Comments

Post a Comment