Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Nifty and Stocks - Daily Analysis - 14th December

Derivative Data Dashboard - 14th December

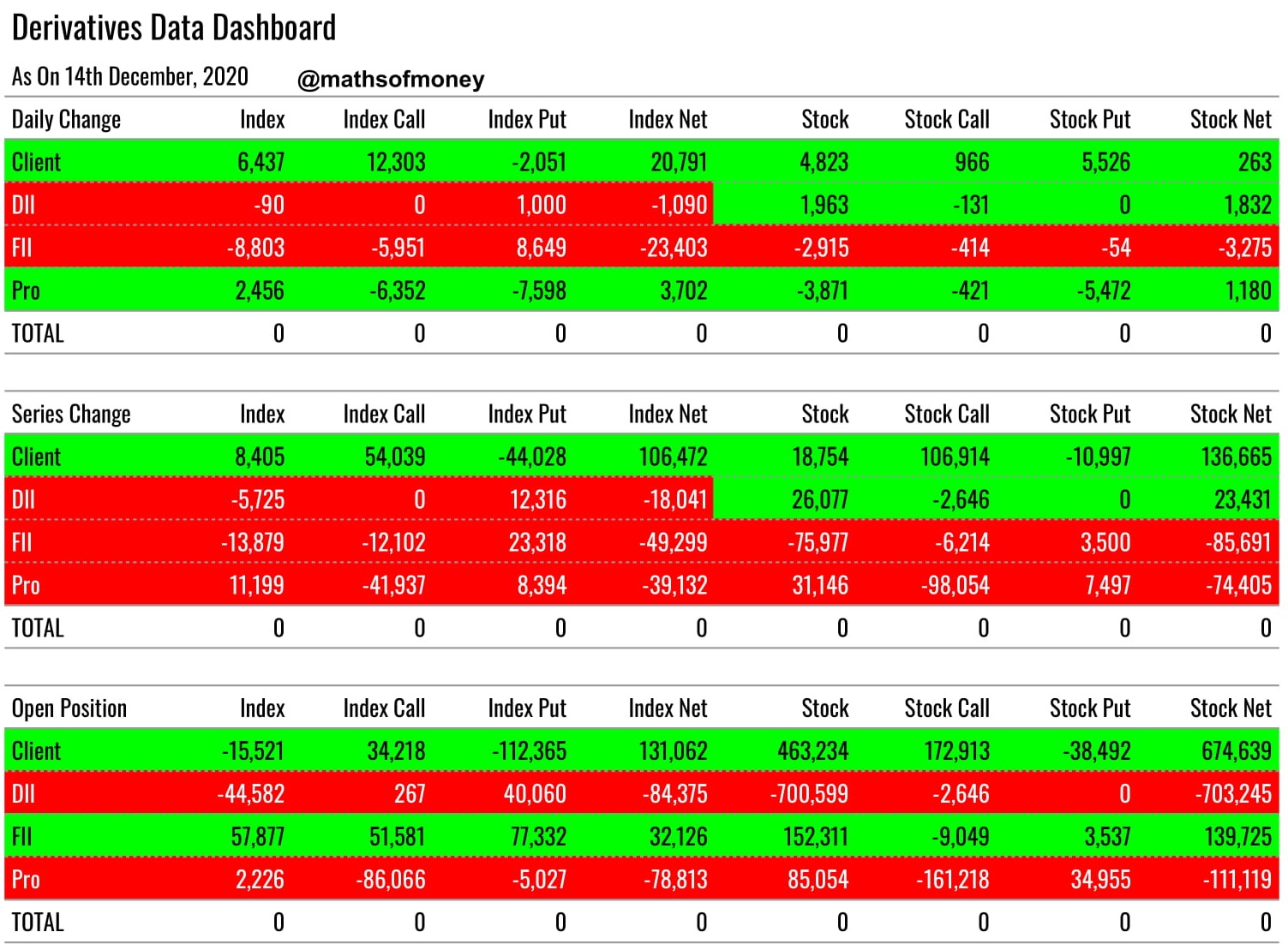

Updated Derivatives Data covering open position, daily trades (change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in futures, call options and put options.

Here are key highlights:

Daily Change in Index and Stocks Derivatives

(Net trades executed today by each participant - Client, FII, DII and Pro):

- Out of total of 24,000 contracts worth of net long positions in Index, Clients have bought in excess of 20,000 contracts. Again a day of significant long position in Index by Clients while all other others are either borderline buyers of significant sellers.

- Clients (Retailers) added 20,791 net long contracts in Index which is a net long position without any internal hedge i.e. Buying Index Futures Contracts (6,437), Buying Index Call Options (12,303) and Selling Index Put Options (2,051).

- Clients were sold these 12,303 contracts of index call options by FII (6,352 Contracts) and Pro (5,951 Contracts). Clear indication of near term premium decay in call options, preferably before next weekly expiry of Index.

- On bullish indicator is Pro have covered their short position in Index Puts by 7,598 contracts out of net short position in Index puts of 12,625 contracts they carried as on last trading day.

- Also important to note that the short position that FII has created today effectively surpassed their investment in cash market for the day. This explains why FII always buys when market is high and sell when market is low.

- DII are net sellers of Index Contracts however not a significant number.

- There has been a muted day for stock derivative as net impact is 3,275 stock short by FII which were bought by Clients, DII and Pro.

Series Change in Index and Stocks Derivatives

(Net trades executed since the beginning of futures monthly series by each participant - Client, FII, DII and Pro):

- Clients (Retailers) added 1,06,472 net long Contracts in Index with no internal hedge (i.e. Futures net buy, Call Options Net Buy, Put Options Net Sell) - This strengthens retail investors bullish view on Index since the begging of this futures series.

- FII, DII and Pro have unwound their long positions during this series consistently while maintaining market at higher price band.

- Same is the case with 1,36,665 net derivative contracts on bullish side opened by Clients in stocks since the beginning of this month series. Another indication of bullish mindframe of retail investors.

Open Positions in Index and Stocks Derivatives

(Open position at the end of today of each participant - Client, FII, DII and Pro):

- Pro have almost all of their net sell position by way of sell of call options which means if index moves any higher up, they would have maximum pain with limited gains equal to premium written by them. The forced short covering of their put sell position today is just the right example of that.

- Pros also have 85,054 contracts of net long position in stock futures which looks hedged against 34,955 put contracts and balance approximately 50,000 against sell of call options. This assumption leaves pros with net short position of 1,11,000 in stocks call options. Which means if stocks move higher from here, Pros have maximum pain situation.

- DII are carrying net short position in Index and also in stocks which is stellar at more than 7,03,245 Contracts. One should also bear in mind DII have sold huge quantities in cash market also over this month. This aggressive shorting can be trapped if there is a significant thrust for the market to move higher and the short covering by DII can take market flying high.

- FII now carries only 40% of long position in Index which they had at the beginning of this expiry, 60% of longs in index has been squared off at high prices and bough by retailers. Also important to note that these net open interest of FII is only by way of Purchase of Call option which entails limited loss to the tune of premium paid in case market goes down plummeting. So FIIs are fully protected in case of a sudden market fall. While their net long position in Stock is lowest since May 2020, which indicates they have booked their share of profit in derivative market while continuing the eye wash of cash market purchase.

- Clients are carrying highest net open positions at the end of the day in Index as well as in Stocks. Also the composition of this position is worrisome. Net long position for clients in index is by way of sell of put options which is maximum pain and limited gain situation. Where as out of 6,74,639 long position in stock contracts, clients carry maximum pain scenario for 5,00,000 contracts which consist of futures long and put short.

In summary, data reflects the distribution of stock and index derivatives at higher prices to retailers continues. Futures contracts have sharply lost their premium since the beginning of the series, however, we are only at the halfway mark in terms of trading days left in this month futures expiry. All these indicate near term weekly expiry or earlier than that we may see market reversing into bearish trajectory.

Comments

Post a Comment