Participant Wise Open Interest - 30th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 30th December

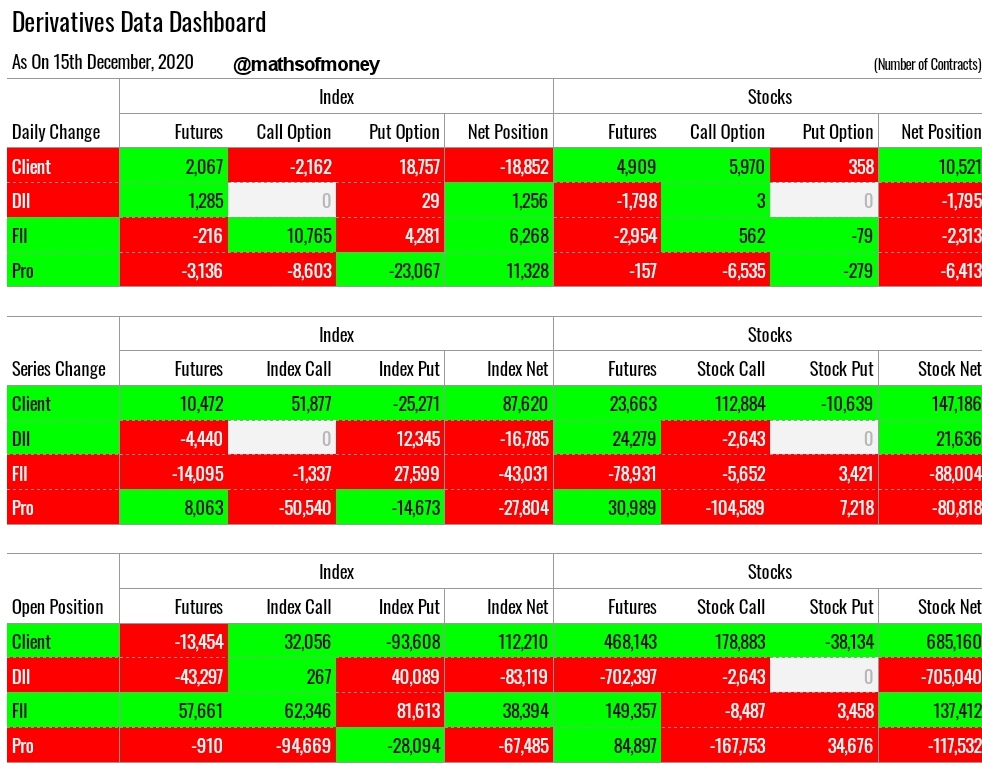

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX remained range bound at 21.

- Brent Oil prices remain buoyant above 51 but there is no run away action as yet

- Dollar Index (DXY) keeps struggling below 90. This was expected in the light of thin volumes and approval of Brexit Deal by UK Parliament

- Nifty daily RSI climbed back above 70, however, weekly RSI is close to 80

Yesterday's Derivative Data Analysis - For Comparison

29th December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients have added 12k stock future longs today and against that booked profit in 30k stock call options. Also strengthened their bullish stance by selling 7k stock put options taking their overall short in stock put options to 28k.

- All in all retail investors stand tall with most of their long positions intact in stock derivatives even one day prior to monthly expiry. What remains to be seen is how much of these longs shall be rolled over to next series and how much profit is booked tomorrow.

- With profit booking in 12k shorts in index put options, clients also added 8k longs by way of buying index call options, overall for the day clients reduced their longs in index by 5k contracts.

- Inspite of this they carry 85k long position in index at the end of the day which gets rewarded thinly on upside but gets punished heavily for the downside. This could be interpreted as an opportunity for the market to make yet another high on the day of expiry giving away nothing to retail investors.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- In spite of markets making all time high on intraday basis and registering highest lifetime closing, DII sold 16k stock futures today. Also sold index futures and bought index put options. All these just one day before monthly expiry.

- However, we continue the assumption that this is still a hedge, that too of non significant proportion, against DII's cash market holdings.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII have bought 21k index call options today. Going by the amount invested by FII in index options for the day, it appears that this buying could very well be of next series index call options. If that is the case, we might see bull run extend into January.

- In the month of December, now FII have unwound more than half of their longs in index derivatives and a significant portion of their longs in stock derivatives also.

- Contrary to this, retail investors are now only net buyers of stock derivatives in December series and they haven't booked profit on any of their longs yet.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO have firmed their stance of range bound movement in index by shorting both index call options and index put options that too in significant quantity.

- PRO have covered 31k shorts in stock call options which reduces their net short position in stocks to 81k. However, they still carry 110k shorts in stock call options which can trigger stop loss in case market moves upwards sharply tomorrow.

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

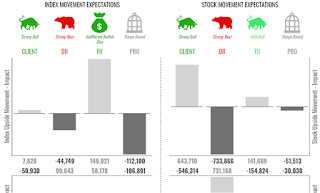

Index Volatility Impact Assessment

- FII have ensured their profit in case market moves either side. However, they are the only ones earning in case indices move up - The Only Bull

- Clients even though have net longs in index, they barely get to earn on upside, however, they do get punished in case of fall that too handsomely

- DII hedged positions are clear cut bearish bets

- PRO are now playing a range bound market move with their risk rewards almost matching in case of sharp movement in either direction.

Stocks Volatility Impact Assessment

- Clients are biggest beneficiary in case of upwards movement in stock prices - strong bull

- FII are distant second beneficiary of rise in stock prices

- DII again hedged portfolio and hence carry strong bearish position in derivatives data

- PRO expect little to no movement in stock prices tomorrow

Comments

Post a Comment