Participant Wise Open Interest - 28th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 28th December

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX reclaimed 20 levels and closed midway between 21 and 20. This simply means there is no clear conviction of unidirectional move in option pricing for monthly expiry.

- Oil prices remain near the breakout levels, consolidating and waiting for a news to shoot up.

- Dollar Index (DXY) keeps struggling to stay above 90 maintaining high hopes for continued liquidity for emerging markets.

- Nifty daily RSI climbs above 70 a bullish indicator while Bank Nifty RSI is still at 65 levels.

Yesterday's Derivative Data Analysis - For Comparison

24th December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) have covered shorts in index call options today. This makes them net long in index call options now while largest shorter of index put options with 98k contracts. Expiry move should be a sharp downside movement to force clients to cover shorts in index put options as well.

- In Stock contracts clients have added their long in stock futures (22k) and booked profit in stock call options (13k). However, they still continue to carry 165k long in stock call options.

- Again with profit booking in client's short in stock put options, the now have net short in stock put options of 20k. All in all, they maintain aggressive bullish stance in stock and Index both.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII continue to add to their hedged positions by selling 5k stock contracts and 3k index contracts while also selling in cash market for the day.

- This means 4-5% redemption pressure in a sudden fall situation is fully hedged by DII. However, any larger redemption pressure would show DII offloading large quantity in cash market.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII, even though invested 1500 Crores in cash market, have sold a similar amount in stock futures.

- With 21k long in index put options, FII added net shorts of 8k in index derivatives.

- FII have used last ten days of intraday volatility and last weeks sharp daily volatility to cover their index derivatives positions completely with highest long position in index call option (73k) and index put option (103k) contracts even this close to monthly expiry.

- This indicates there is still a downward movement waiting in December series.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO are forced to cover some of their shorts in stock call options (12k) and also they booked losses in some of their stock put longs (8k). Believe it or not, this was forced on PRO by Clients - Retail Investors - something that has been rarely seen before.

- On net level, PRO covered 16k shorts in stock derivatives and still carry 109k short contracts in stock derivatives. And a direct conflict can be seen in stock call position against clients, remains to be seen who wins the battle of December on this front.

- By adding new shorts in index call options (31k) and index put options (28k), PRO affirm they do not expect sharp movements in Nifty and Bank Nifty till this expiry.

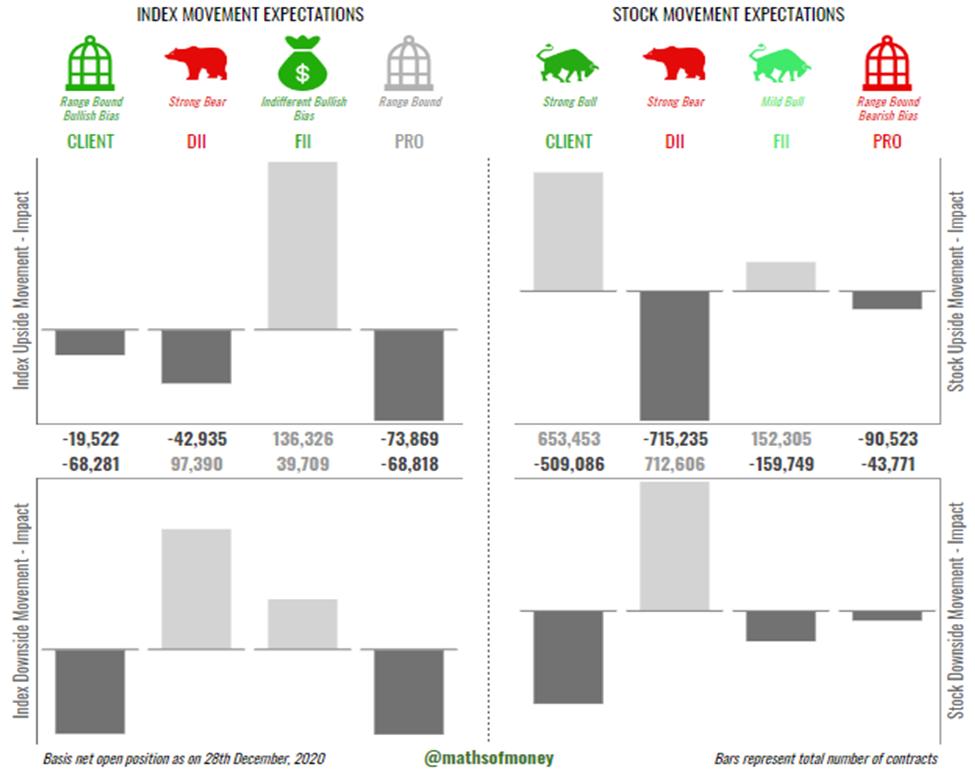

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- FII have increased their comfort for fall in index by BUYING index put options just three days ahead of expiry - they do not seem to worry about premium decay.

- Clients remain bullish with no participation in case index moves up.

- DII are strong bearish on index which is presumed as hedge against their cash market holdings.

- PRO strengthen their range bound stance in index with being biggest losers in case index moves up.

Stocks Volatility Impact Assessment

- Clients are all in bullish in stocks with 500k contracts losing in case stocks fall from this levels.

- DII are all aggressive bears

- FII are mildly bullish on stocks, as for each 1 Rs that FII shall earn from upward movement in stocks, Clients would earn 4 Rs. The question is - since when did market / FII become so philanthropic?

- PRO expect stocks to remain range bound with strong bearish bias.

Comments

Post a Comment