Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Nifty and Stocks - Daily Analysis - 15th December

Derivative Data Dashboard - 15th December

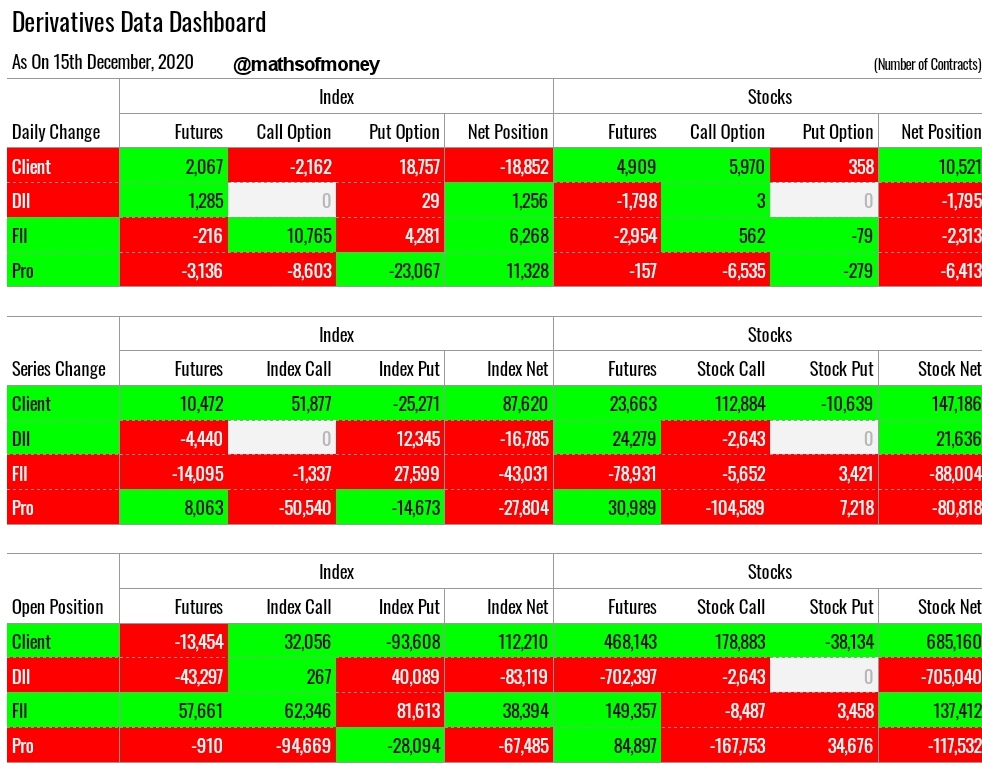

Participant wise Derivative Data including open positions, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in futures, call options and put options.

Here are key highlights:

Daily Change in Index and Stocks Derivatives

(Net trades executed today by each participant - Client, FII, DII and Pro):

- Daily net change in index and stocks are contradictory today with Retail being net seller of Index Contracts whereas net buyer of Stock contracts.

- Net index sell by Retail comprises mostly of long positions of 18,757 put contracts. This is a limited risk exposure for clients in case of significant upside and on the other hand they have hedged 15% of their net index long position with this trade for the day.

- Clients (Retail) have created 10k contracts worth of net long positions in stock. This is continuation of trend we are seeing since last few days.

- DII have had a relatively muted day for index trade however they continue to sell stock futures along with sale of stock in cash market. They are the most aggressive shorters in the market as of now.

- A big short term bullish indicator is FII buying 10k index calls today. This even though when net off against ~4k put they have bought leaves them creating long of 6k contracts in index by way of purchase of calls. This again is a safe bet considering it carries limited downside risk. However, because we are only two days away from weekly expiry, one may deduce that next two days could see up mode in index to allow FII to book profits in these call options.

- Another bullish indicator with maximum pain situation is Pro selling 23k put contracts,l. Even when net off against their sell position in index futures and call options, Pro sold net 11k put contracts for the day. This means any downside in index from here could be maximum pain situation for Pro. This again supports this weekly expiry to remain either range bound or bullish so that Pro can square off their net sell position in Index put.

- Both FII and Pro have been net sellers of stocks contracts in line with last few days.

Series Change in Index and Stocks Derivatives

(Net trades executed since the beginning of futures monthly series by each participant - Client, FII, DII and Pro):

- Clients (Retailers) continue to be only bullish participant in December, 2020 series with 87k net long position in Index. 36k contracts out of these being unlimited loss instruments by way of sell in future contracts and put options.

- Client also continue to be net buyers of stocks in this monthly expiry with net 147k contracts added in stocks, however only 33k out of those are unlimited loss instruments.

- FII, DII and Pro have unwound their long positions during this series consistently while maintaining market at higher price band.

Open Positions in Index and Stocks Derivatives

(Open position at the end of today of each participant - Client, FII, DII and Pro):

- Pro carry 67k net sell position by way of sell of call options which means if index moves any higher up, they would have maximum pain with limited gains equal to premium written by them. The forced short covering of their put sell position today is just the right example of that.

- Pros also have similar nature of short for stock contracts which comprises of net sell of call options. Unless this is hedge against their holding in cash market, this is a high risk scenario for Pro in case market moves any higher.

- DII are carrying net short position in Index by way of sell in futures and purchase of puts in almost equal proportions. Whereas their net short position in stocks is a towering amount of 700k contracts by way of sell of stock futures. Unless this is a hedge against their cash market holding, it's a solid short stand which DII carried into December Series and maintain.

- FII now carries only 40% of long position in Index which they had at the beginning of this expiry, 60% of longs in index has been squared off at high prices and bough by retailers. Also important to note that these net open interest of FII is only by way of Purchase of Call option which entails limited loss to the tune of premium paid in case market goes down plummeting. So FIIs are fully protected in case of a sudden market fall. While their net long position in Stock is lowest since May 2020, which indicates they have booked their share of profit in derivative market while continuing the eye wash of cash market purchase.

- Clients are carrying highest net open positions at the end of the day in Index as well as in Stocks. Also the composition of this position is worrisome. Net long position for clients in index is by way of sell of put options which is maximum pain and limited gain situation. Where as out of 6,74,639 long position in stock contracts, clients carry maximum pain scenario for 5,00,000 contracts which consist of futures long and put short.

In summary, when data is read in conjunction with VIX maintaining around 19.5, last five days of range bound market, reflects the distribution of stock and index derivatives at higher prices to retailers continues. However, any significant move above the recent high of 13597 could very well take index flying high by 200 odd points fuelled by short covering for max pain positions. Bearish stance shall become strengthened only on closing below 13400.

Very nice analysis.

ReplyDeleteI am glad you liked the analysis. I have added few info graphics. Please let me know your feed back on those as well.

Delete