Participant Wise Open Interest - 23rd December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Interest Analysis - 23rd December

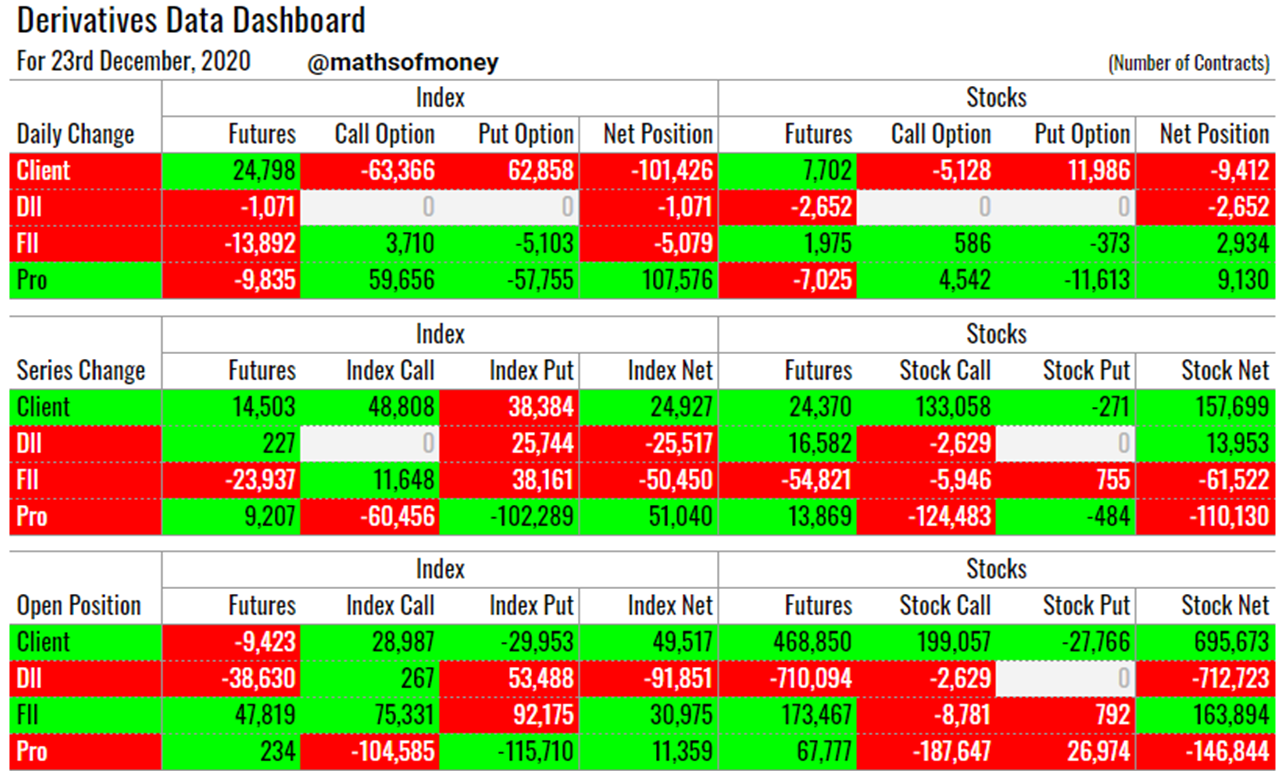

Welcome to the daily analysis of Participant Wise Open Interest including day end participant wise open interest, daily trades (net change for the day in the open interest) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants namely Clients, FII, DII and PRO.

Before we start with derivative data, please note that India VIX has contracted today to just below 22 (still uncomfortable territory for bulls) and Dollar Index (DIX - the ultimate source of liquidity) retracted from 91 levels. Keep a keen eye on these two factors along with movement in Oil prices to get a general direction of world markets as well.

Yesterday's Derivative Data Analysis - For Comparison

22nd December - Dashboard

Today's Participant Wise Open Interest

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients, even though have created net short positions for the day in both index, interestingly they are the net buyers of index futures and stock futures for the day. This has to be considered with the fact that index options have weekly expiry which is tomorrow, however, index futures, stock futures and stock options are only monthly expiry which is next week.

- In spite of heavy unwinding of long positions by clients, they still remain single largest participant with net long positions in stocks as well as in index.

- Also considering the fact that today's volumes were much lower than the average, net carried open interest at the end of the day would carry more effective stance than trades executed for the day.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII has had yet another low volumes day with built up of short in index futures (1k) and stock futures (3k) both.

- Also DII have sold 1300 Crs of stocks in cash market which is much more than what FII have bought today.

- DII now stand as the only participant with short positions in Index (92k - Nifty and Bank Nifty) and with largest short positions in Stocks (713k).

- An interesting point of view to analyse this, assuming that DII's short positions are only hedge (that too a non-significant proportion) against their cash market holdings, today's net open positions says all the participants are bullish in the market - the profits to Clients, FII and PRO shall be equal to the hedged position loss to DII. Such scenario shall mean market could go to make new all time highs. A funny and scary bull case.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII have created net short positions in Index and net long in Stocks.

- The interesting part, though, is their short built up for the day in index futures is significant at 13k contracts. Considering their hedge through index options against this short in futures, it is safe to assume index (Nifty and Bank Nifty) shall see higher levels than today's close for sure.

- FII happens to carry long open interest in index and in stocks, however, the quantity stands significantly reduced. This indicates that though the market is still in the upper band of December Series prices, FII is not building up longs to participate in further upside. This remains the cause of concern for bull case.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO are the only participants to build up long in index (both Nifty and Bank Nifty), that too of a significant quantity (108k), their long build up is ONLY THROUGH INDEX OPTION POSITIONS.

- Therefore, this can be validated only basis tomorrows open interest data after the weekly expiry. Because, even with huge net long build up, PRO have shorted index futures for the day.

- Also, Net open interest of PRO in index remains only at 11k contracts, it indicates that they are expecting range bound market,at least this weekly expiry, because of huge shorts in both index call options (105) and index put options (116k).

- In spite of short covering of 9k contracts in stocks, PRO are still net short in stocks by 147k contracts and most important component of this is 188k short stock call options which are invariably monthly expiry.

- All this contrasting positions indicate that tomorrow may be the last laugh for bulls.

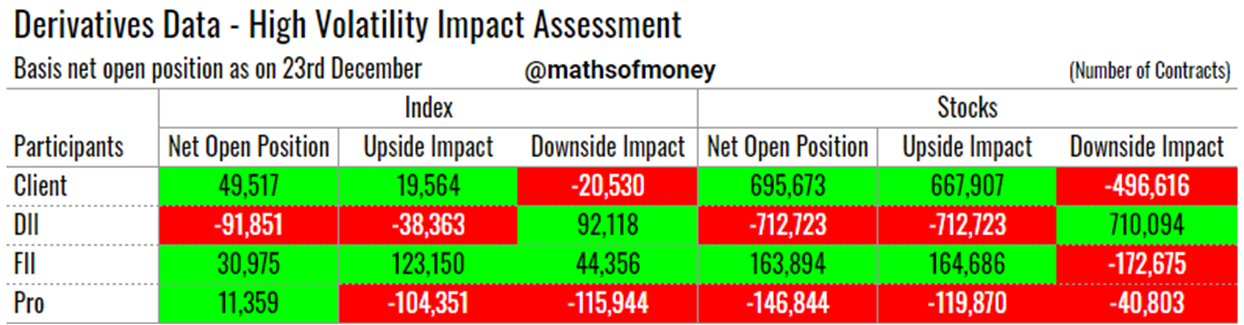

High Volatility Impact Assessment for Open Positions in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility heat map:

Index Volatility Impact Assessment

- FII remain gainers in either side movement.

- Clients have thin participation now in the market in any direction, even though its balanced between gain on the upside and loss on the downside.

- PRO have a strong range bound expectations - atleast for the weekly expiry.

- DII, with net short position, is set for full participation in downside gains and limited loss in upside losses.

Stocks Volatility Impact Assessment

- FII & DII have balanced impact in case of upside or downside movement in stocks and earning on the upside and downside respectively.

- Clients are biggest beneficiaries in case of upside movement in stocks and biggest losers in case of fall.

- PRO happen to carry range bound expectations for stocks as well.

Comments

Post a Comment