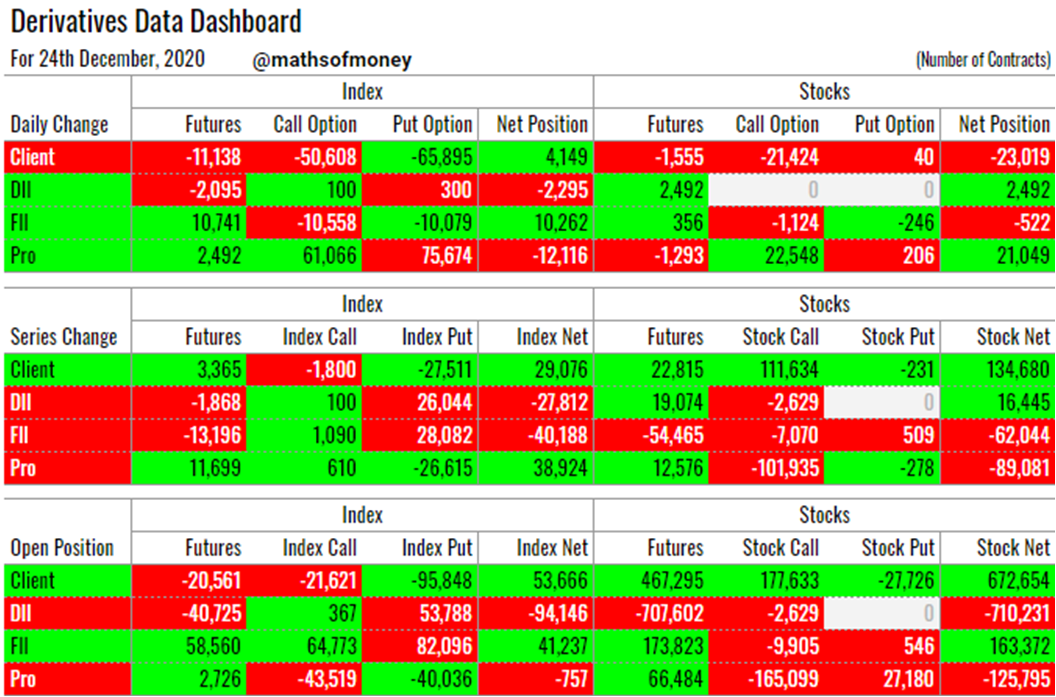

Participant Wise Open Interest - 24th December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 24th December

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX has dropped significantly to just below 20. Even though this remains above 18 which is comfortable levels for bulls to rule the market.

- Oil prices has seen spike recently with storage data indicating reducing inventory. Oil being India's largest import, affects our economy and currency adversely.

- Dollar Index (DXY) could not conclusively cross 91.10 to market above 92 levels, but is steady between 90 and 91. As soon as dollar index crosses 91.10, we might see liquidity drying up quickly which is the sole contributor pushing the market higher

- All the good news which market was bracing or hoping for are accounted for i.e. Brexit Deal and US Stimulus. Now what remains to be see is - will the union budget provide next good news for market to keep chasing all time highs or it will be the catalyst to start the bear movement in the month of January.

Yesterday's Derivative Data Analysis - For Comparison

23rd December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) have gone net long in index contracts for the day by 4k contracts. Large quantities Sell in both index call options (51k) and index put options (66k) could either be profit booking for weekly expiry or set up for next week trade.

- However, looking at open interest at the end of the day, with 96k short in index put options, there is a visible complacency in retail investors for market to move up.

- In Stock contracts, clients booked profit in their call options by selling 21k stock call options and a 1.5k stock futures. In spite of this profit booking, clients carry largest long position in stock among all market participants with 672k long in stock contracts.

- These two put together keep indicating that market is very close to topping out.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII have had yet another muted day, just like the rest of this week with 2k contracts short in index futures and similar quantity long in stock futures.

- However, they keep carrying their huge short positions in stocks and index.

- Even though this remains a very small percentage of equity holding of DII, and all the redemption pressure is anyways seen addressed by way of their daily sell in cash market, they position is sell of stock futures which is not an optimum hedge as compared to buying of stock put options. However, it is difficult to read market direction basis DII's open position at the end of the day.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII seem to have booked profit in both the sides of index options and created a net long position in index futures of 10k contracts.

- Even with todays net long position in index, FII's have unwound half of their long positions so far in index in December month and now only carry 40k long contracts in index.

- With minimum participation in stock derivatives today, FII stays long in stock contracts at approximately 70% of their long position since the start of December series.

- Even though this might look as a bullish indicator, it must be noted that their highest long position in stocks was almost equal to what retail is carrying today. This means FII have handed over their derivative longs, created around May to retail investors during November and December. This remains another anticlimactic fact for market to keep rising further.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO have covered their shorts in index call options (61k) and index put options (76k) by significant quantity. Some of this short covering could well have been the reason to fuel sharp rise in the market yesterday.

- With this short covering in index, PRO now have negligible net position in index however they still carry 40k odd shorts in both index put options and call options.

- Short covering was seen by PRO in stock call options today and in spite of this, PRO continue to carry huge short positions in stocks (126k) and even higher shorts in stock call options (165k). Another barrier for the market to climb.

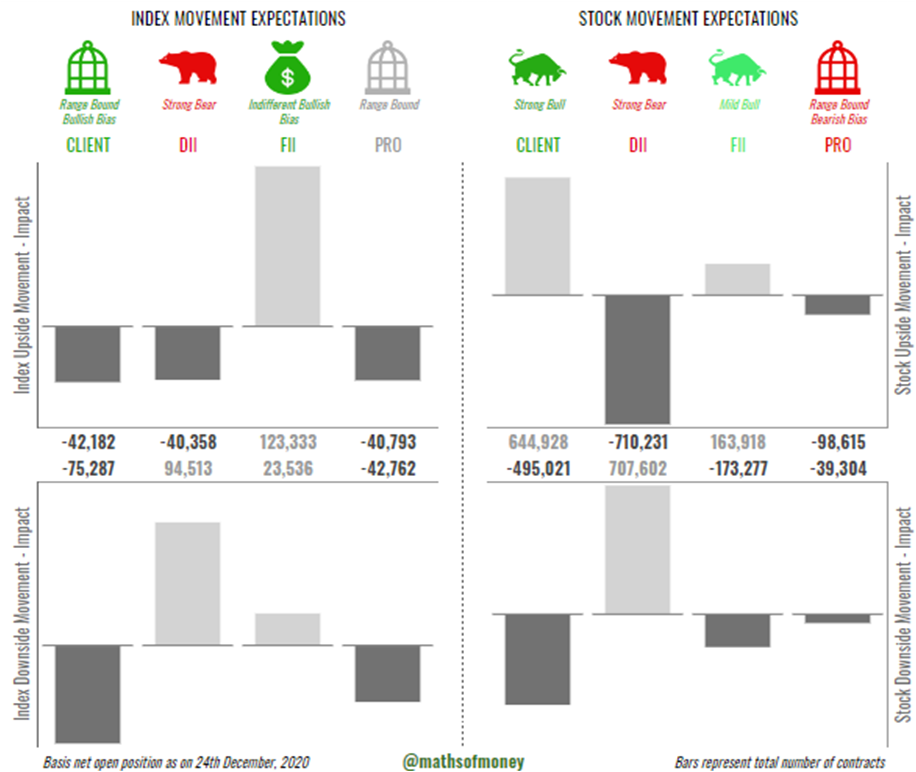

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- FII are indifferent to market movement as they make money both sides. However, they carry bullish bias with more returns expected in case of upward movement in Nifty and Bank Nifty.

- Clients expect market to remain range bound and bleed the most in case of downside movement in index.

- DII carry strong bearish positions with large gains on downside and relatively smaller losses on upside.

- PRO also expect market to remain range bound and their positions both sides are largely balanced.

Stocks Volatility Impact Assessment

- Client have strong bullish stance with being biggest beneficiary of any upward movement in stocks and also being biggest losers in case of fall in stock prices.

- FII remain mildly bullish with almost balanced positions to gain in rise and lose in fall of stocks.

- PRO have a range bound view for the market with strong bearish bias as they stand to lose three times in case of rise in prices against what they stand to lose in case of fall in prices.

- DII have strong bullish positions in stocks with being biggest losers of rise in prices.

Comments

Post a Comment