Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Nifty and Stocks - Daily Analysis - 17th December

Derivative Data Dashboard - 17th December

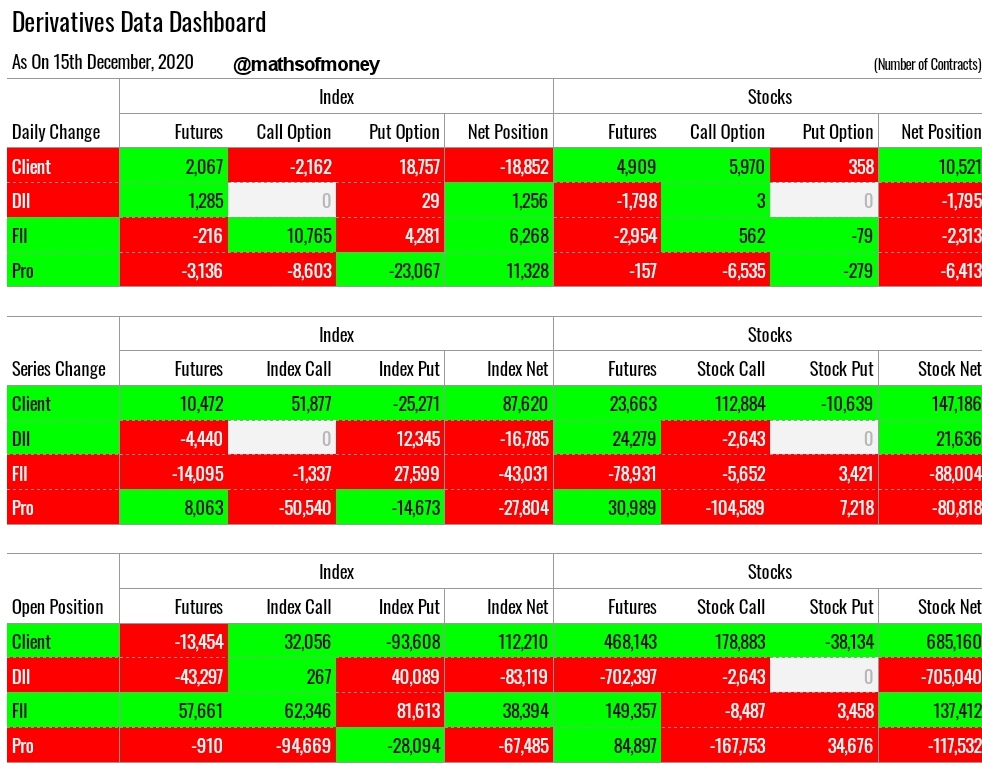

In depth analysis of Derivative Data including open positions, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in futures, call options and put options for each category of participants.

Yesterday's Derivative Data Analysis - For Comparison

16th December - Dashboard

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades executed today, from the beginning of this monthly series and open positions at the end of the day in Futures, Call Options and Put Options):

- Clients (Retail Investors) have again executed contrasting trades by going short in Index and long in Stocks.

- Long positions (16k) were created in stocks by way of buying of call options (13k - a relatively safer bullish bet) and sell of put contracts in very small quantity (3k - a highly risky bullish bet).

- This takes clients net long position in stocks since the beginning of the series to 162k contracts and a substantial portion of this has been by way of buying of call options (129k). This reflects clients cautious participation in the bull run in December series.

- However, net open position in stocks is 700k contracts long. This comprises mainly of long position in stock futures of 466k contracts add to this sell of put contracts of 39k and this becomes long built up with full bullish complacency - a strong bear case.

- Clients have created net short position (24k) in Index Contracts by way of selling of Index Call Options (70k). Also important to notice that clients have sold Index Put Contracts also in huge quantity (46k). This means clients expect Nifty and Bank Nifty to remain range bound at least till next weekly expiry.

- Net open position in the index is 24 long contracts, however, the composition shows a much higher exposure both sides with 43k call options short and 80k put options short. This confirms clients expectations for range bound moves in Nifty with bullish bias.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades executed today, from the beginning of this monthly series and open positions at the end of the day in Futures, Call Options and Put Options):

- DII's trade for the day is very simple - buying of 9k index put options and buying of 5k stock futures. This means hedge in Index against fall in Nifty and Bank Nifty where as naked participation in bull run through stock futures longs.

- DII's net trades for December series also confirm the same view we can see from today's trade. We must bear in mind that they have been selling in the cash market as well on daily basis without fail.

- However, DII's net open position at the end of the day shows aggressive and fully exposed short position in stock contracts of 700k. Where as semi exposed short position in Index contracts of 93k. This means their position is nothing but hedge for their portfolio and since this position is carried even from the beginning of December Series, it is clear that DII have not participated in bull run of December for their open position which is approximately 55k Crores and around 4-5% of total equity AUM with MF's. This means - DII are still to book profits.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades executed today, from the beginning of this monthly series and open positions at the end of the day in Futures, Call Options and Put Options):

- FII's trades for the day were muted at the net level. However, there is high quantity of shorts in Index Put (20k) as well as in Index Call (10k). With sell of 5k index futures FII end up unwinding index future contracts (14k) in December which also reflects net trades by FII during December series in index contracts.

- Most interesting part is FII's open position of 70k contracts long in index comprises of 65k long in index call options. This shows that todays net position FII has limited downside risk and extremely high participation in any upside move in Indices.

- With todays sell of 4k stock futures, FII have unwound 86k stock futures in December while maintaining stock prices at their peak.

- Net open position in stock contracts is by way of long in stock futures which is full participation in upside as well as in downside. So naked position.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades executed today, from the beginning of this monthly series and open positions at the end of the day in Futures, Call Options and Put Options):

- Pro's have created net long position in index today which is by way of buying of index call options. This is again a limited downside risk and full participation in upside movement. This would seem like PRO's are looking for one directional upside move in index.

- However, their net option position in index contracts at the end of the day shows they carry shorts in index call options (22k) as well as in index put options (22k). Which means they are playing for range bound Nifty and Bank Nifty in December series.

- Another contradiction is PRO's net position in stock options which has 183k short stock call options which when hedged against 85k long in stock futures, leaves naked short in stock call options of 98k. This is highest short of call options by any participant and by far means either sharp downside move for stocks or hedge by PRO's for their cash holdings.

High Volatility Heat Map for Open Positions in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this composition, we have prepared a heat map reflecting how many positions actually carry unlimited downside or upside risk for each participant. This essentially maps most comfortable participant in each directional movement.

- Here is today's derivative data high volatility heat map:

Index Volatility Heat Map - Analysis

- FII is in the most comfortable situation with minimum impact in case of downside and highest participation in upside move.

- Clients and PRO both hurt substantially in case of large movement either side as their positions are largely by way of selling of options.

- While DII is the biggest beneficiary of a steep downside movement, and only half the risk exposure in case of an upside move.

Stocks Volatility Heat Map - Analysis

- FII, Clients and DII all three have balanced composition of their open position in stocks - risk and reward almost in the same range for movement in either direction.

- PRO hurt substantially in case of large movement in stocks either side as their positions are largely by way of selling of options.

Comments

Post a Comment