Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Nifty and Stocks - Daily Analysis - 11th December

Derivative Data Dashboard - 11th December

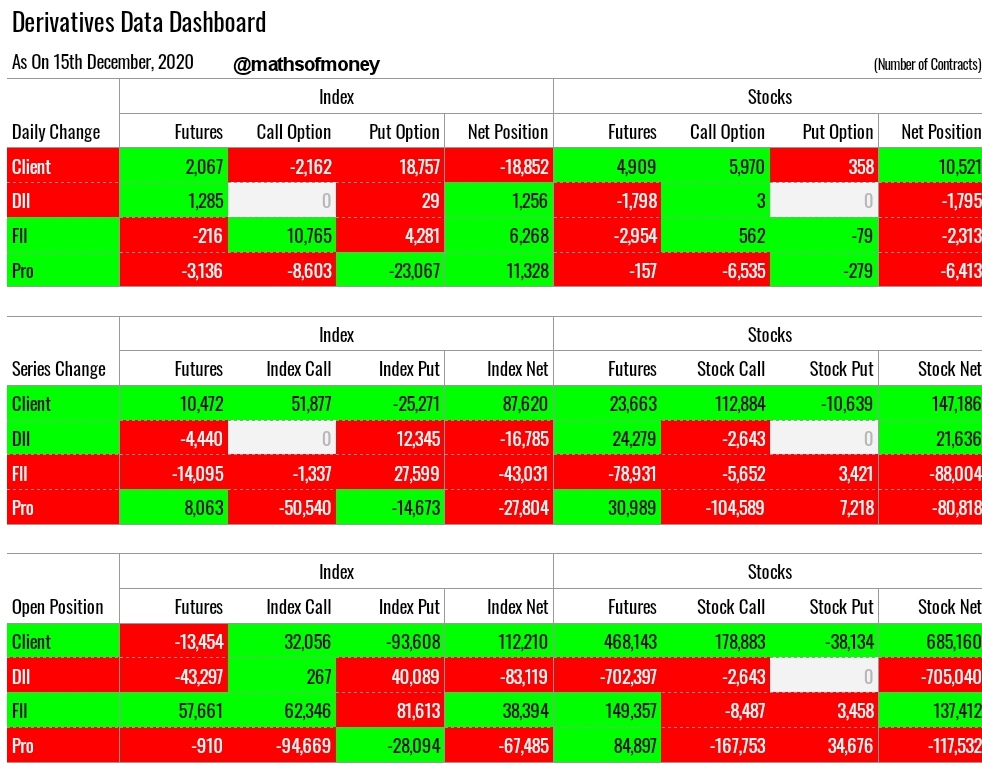

Here is daily updated analysis of Derivatives Data covering open position, daily trades (change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in futures, call options and put options.

Here are key highlights:Daily Change in Index and Stocks Derivatives

(Net trades executed today by each participant - Client, FII, DII and Pro):

- Clients (Retailers) added 41,103 net long contracts in Index with selling of 14,877 contracts of Puts which is maximum loss scenario in case market crashes.

- Clients short position in Nifty of 5,827 contracts and equivalent amount of call buying, if assumed as hedged short position in Index Futures, still that leaves clients adding balance 27,000 contracts of Index Call as net long positions.

- FII, DII and Pro all three were net sellers of Index Contracts which indicates distribution as this is happening near the peak point of Nifty and Bank Nifty.

- Both Clients and DII have added just under 9,000 contracts worth of net long positions in stocks where as FII and PRO are net sellers of stock derivates for the day.

Series Change in Index and Stocks Derivatives

(Net trades executed since the beginning of futures monthly series by each participant - Client, FII, DII and Pro):

- Clients (Retailers) added 85,681 net long Contracts in Index with no internal hedge (i.e. Futures net buy, Call Options Net Buy, Put Options Net Sell) - This clearly demonstrates retail clients are now absolutely complacent on Index Bullish movement which is indication of impending correction in Index

- Same is the case with 1,36,402 net derivative contracts on bullish side opened by Clients in stocks since the beginning of this month series. Another indication of bullish mindframe of retail investors.

- While FII, DII and Pros have offloaded huge quantities in Index Contracts while maintaining the index near its top.

Open Positions in Index and Stocks Derivatives

(Open position at the end of today of each participant - Client, FII, DII and Pro):

- Pro have almost all of their net sell position by way of sell of call options which means if they let index move any further, they would have maximum pain with limited gains equal to premium written by them.

- Pros also have 88,00 contracts of net long position in stock futures which looks hedged against 40,000 put contracts and balance 48,000 against sell of call options. This assumption leaves pros with net short position of 1,12,000 in stocks call options. Which means if stocks move higher from here, Pros have maximum pain situation.

- DII are carrying net short position in Index and also in stocks which is significantly higher at more than 7,00,000 Contracts. One should also bear in mind DII have sold huge quantities in cash market also over this month. They are looking to close their net shorts of stocks at much lower levels this month.

- While FII carries long positions both in Index as well as in Stocks, this has reduced to around two third levels as compared to their long positions since the beginning of this series. They have distributed their open position at higher prices for sure.

- Clients are carrying highest net open positions at the end of the day in Index as well as in Stocks with 1,10,000 and 6,70,000 contracts respectively. This is extraordinarily high long built up considering DII, FII and Pro all are either net short or reducing their long positions.

In summary, data reflects the market is being distributed at higher prices to retailers. Such a scenario usually is followed by a steep crash (not just correction).

Comments

Post a Comment