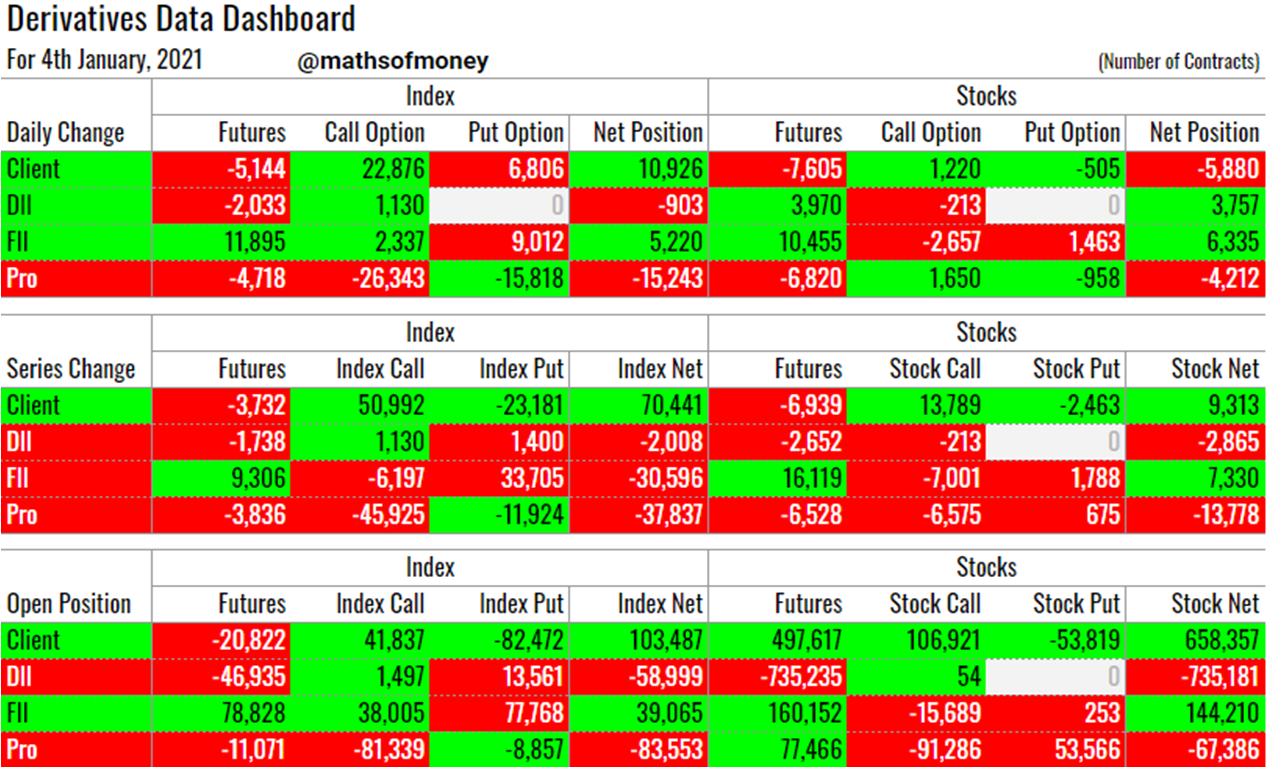

Participant Wise Open Interest - 4th January - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 4th January

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX while crossed 21 during the day when markets fell in the first half however corrected sharply to close below 20 once Nifty recovered in the second half

- Oil prices remained subdued with OPEC sounding concern on demand remaining under pressure through first half of 2021.

- Dollar Index (DXY) again failed to cross over 90 and retreated back to 89.50 levels.

- Nifty daily RSI reached 76 which means there is still some steam left in the index, however, Bank Nifty daily RSI is still only at 66 which reflects in its range bound price action.

Yesterday's Derivative Data Analysis - For Comparison

1st January - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- With 11k new longs added in index, Clients (Retail Investors) are now carrying 103k long contracts in Nifty and Bank Nifty and 70k of those are added in the first two days of January - all time highs for Nifty

- Even though today's longs were mostly by way of buying of index call options, they still have carried interest of 82k index put options written.

- After an insignificant profit booking in stock derivatives, clients are still long in stock futures by 659k contracts which participates almost fully in any downside in stocks.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Unlike the usual, DII have covered their shorts in stock futures by 4k which might be profit booking from the hedges position against their cash market sell of 750 Crs for the day.

- With negligible shorts added in index contracts, DII remain short on Index as well as Stocks.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Today's FII's data shows buying in cash market, index futures, index options, stock futures and stock options.

- This data is misleading to the actual play as the long in index futures were covered by buying of index puts, long in stock futures were also covered in half by buying of stock put options and selling of stock call options.

- Also for the month of January, FII have added longs of 7k contracts in stocks and reduced longs of 31k contracts in index. Assuming 7.5 Lacs as the value of each contract (effective value even for options), in these two days FII have booked profits / hedged 1,800 Crs worth of position.

- All in all, as long as FII are still carrying longs on stocks we shall continue to see stocks out performing may be in rotation until they are able to either hand over these longs to other participants or they start building up new longs when retail investors lose their complacency and high participation in upside movement of market.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO have written all the net addition to index call options for the day and also continue to write all the net open position in the index call options. This shows they are hunting for higher premiums on the calls and also a possibility that in case there is sharp upmove or gap up, it would be further fueled due to short covering of call options by PRO's.

- Stock call options writing by PRO on net open position is also significantly important as these calls are bought by retail investors. The question now is - can retail investors push stock prices higher enough for them to force PRO to cover their shorts?. Remember FIIs are also net writer of stock call options which make the fight tougher for retail investors.

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- FII are biggest beneficiaries of any upward movement in Nifty and Bank Nifty with fully covered downside risk

- Clients gain moderately in case of rise in index but stand to lose 3x in case of fall - their trade set up more of "MARKET SHALL NOT FALL" than "MARKET SHALL GO UP" - the difference between the two is - former is EUPHORIA and the later is COMPLACENCY

- DII continue their hedge bets - remain bears as always

- PRO are placed directly against retail investors by losing in case index goes up

Stocks Volatility Impact Assessment

- Clients and FII stand to gain in case stocks move up which is forgone profit by DII on their hedged positions

- PRO are expecting stocks to move nowhere significantly and are looking to cash in higher stock option premiums

Comments

Post a Comment