Participant Wise Open Interest || 11th Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Follow @mathsofmoney

Participant Wise Open Interest Analysis based on 11th January FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: Rose sharply to close at 22.40. This could partly be because of FINNIFTY starting to trade. However, volatility index will definitely make bulls nervous at this levels and any rise above 24 could be the initial indication of trend reversal.

- Dollar Index: Strength is now visible in green back with almost everything that was crucial to Forex trades is now done and dusted with. DXY sustaining at and above 90.50 is still a little early, however, closing above 91 levels is a strong sign of liquidity drying down. And let's face it - LIQUIDITY IS THE NURSING MOTHER OF EMERGING MARKET EQUITY.

- Oil: Could not run away after strong closing to last week. However consolidation at this rate supports the view that Oil is ready to fly, probably waiting for a catalyst.

- Daily RSI: Nifty daily RSI is at 79.73 - rarely it is seen that the leading index can sustain RSI above 80 - this means even intrady basis correction or consolidation at this range can't be rules out. Bank Nifty daily RSI contracted to 71, however as long as it doesn't conclusively cross down 70, the recent trend may continue to dominate.

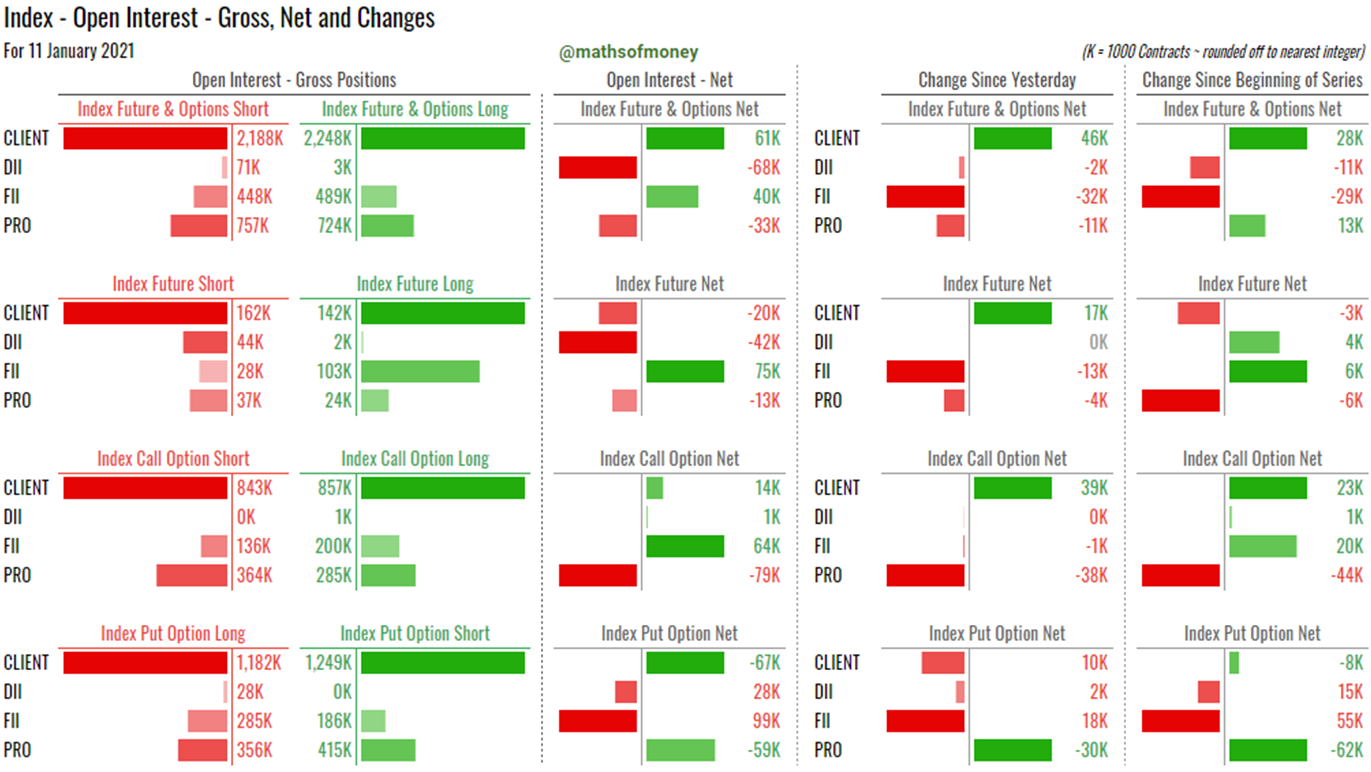

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients have added 46k net longs in Indices today and the bulk of it is a relatively safe bets with buying of index call option (39k).

- However, at gross levels clients have added astonishing open Interest (~200k) mostly in index call options (buy and sell) and index put options (buy and sell).

- Today's open interest in indices by clients is either equal to more than open interest of all other participants put together. So clients continue to dominate open interest in NIFTY, BANKNIFTY and FINNIFTY. Therefore - "INDEX REMAINS A DEMOCRACY"

- With NIFTY RSI being where it is and clients having 50% or more open interest in indices, we may expect atleast a small but sharp correction or consolidation (plot for option premium decay) over next few days especially because of 1.249 million index options that clients have written.

- On stocks front, clients didn't have a significant net change on overall level, their almost half a million long in stock call options is again confirming that rotation (across stocks and sectors) will continue.

- This is also evident with NIFTY making new high today (on intrady and closing basis) the darlings of rally like Bajaj Finserv, Bajaj Finance, Reliance, Kotak Bank failed to impress.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- With 2k short added in indices and covering of 10k short in stock futures, DII continue in their groove mostly balancing their hedge against the cash positions.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- FII have unwound 32k long in indices today which is the exact long they created yesterday.

- Even though their participation is slim in index open interest, the fact that they added 18k index put options today taking their total net long in index put options to 99k contracts, may be indicates they are expecting to lower fund infusion in cash market and resultant pull back is protected against by paying premium for index pu options.

- FII had almost no action in stock derivatives at net or gross levels. So they continue to hold massive long open interest in stock futures at gross levels and this is something which is keeping bulls interested.

- The massive 6,000 Crs inflow by FII in cash segment on previous trading day is largely explained by MSCI rebalancing focused around forced delisting of Chinese firms from NYSE.

- With dollar index shooting up and holding above 90.50 means that the liquidity for equity in emerging market can dry up fast if dollar keeps getting stronger.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro remain firm on their stance of market being range bound by selling both index call options (38k) and index put options (30k). On net open interest basis, Pro are the only writers of index call options and FII are the major buyers.

- However on gross levels open interest of Pro in none of the instruments of indices are significant enough to matter.

- Even though Pro's net change in open interest in stocks was minimal, interesting combination is in net open interest for stock option contracts:

- Stock call options - Pro are the writers for Clients

- Stock put options - Clients are the writers for Pro

- Who shall win this battle remains to be seen.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients in spite continuing to dominate index, do not earn on upside and end up hurting the most in case of fall.

- FII sit fully hedged with being only gainers of index moving up due to their net long in index futures.

- DII continue their hedge bets - remain strong bears by standing to gain the most in case of fall

- Pro are now now heavily invested to keep indices contained on the upside and would also want the downside to be short lived and shallow.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients are long in stocks primarily by their exposed long in stock futures.

- FIIs long in stock futures of almost 700k is the key for bulls however they do have most of their longs covered in contrast to clients.

- DII remain largest shorts in stocks which is dismissed as hedge.

- Pro's story for stocks resemble that of indices - upside is unacceptable, can love with slight downside though.

Follow @mathsofmoney

Comments

Post a Comment