Participant Wise Open Interest || 21st Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Follow @mathsofmoney

Participant Wise Open Interest Analysis based on Today's FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: Having contracted substantially yesterday India VIX could regain some of its lost ground and closed around 22.20. This is only confirming choppy trades ahead with earnings coming in and then much hyped Union Budget.

- Dollar Index: In spite of a lot of positive data supporting faster than estimated economic recovery for the US, dollar index is unable to make any big moves. May be a much clearer direction from new administration on fiscal aspects is the push it's waiting for. As discussed earlier, 91 & 92 are the two important hurdles which will decide the fate of fund flow we are witnessing now.

- Oil: Oil is making minor gains / consolidating at current rates. It's the economic recovery, not just the US but global, which is primary factor here as inventory data disappointed and there are no major events involving OPEC in the sight.

- Daily RSI: RSI climbed above 71 along with rise in indices yesterday, however, today Nifty Daily RSI gave up the levels of 70 and closed around 68.60. Reclaiming level of 70 means the upside to retest 80 levels is open however, today's last hour fall has created divergence in RSI. May be a little respite to the bears.

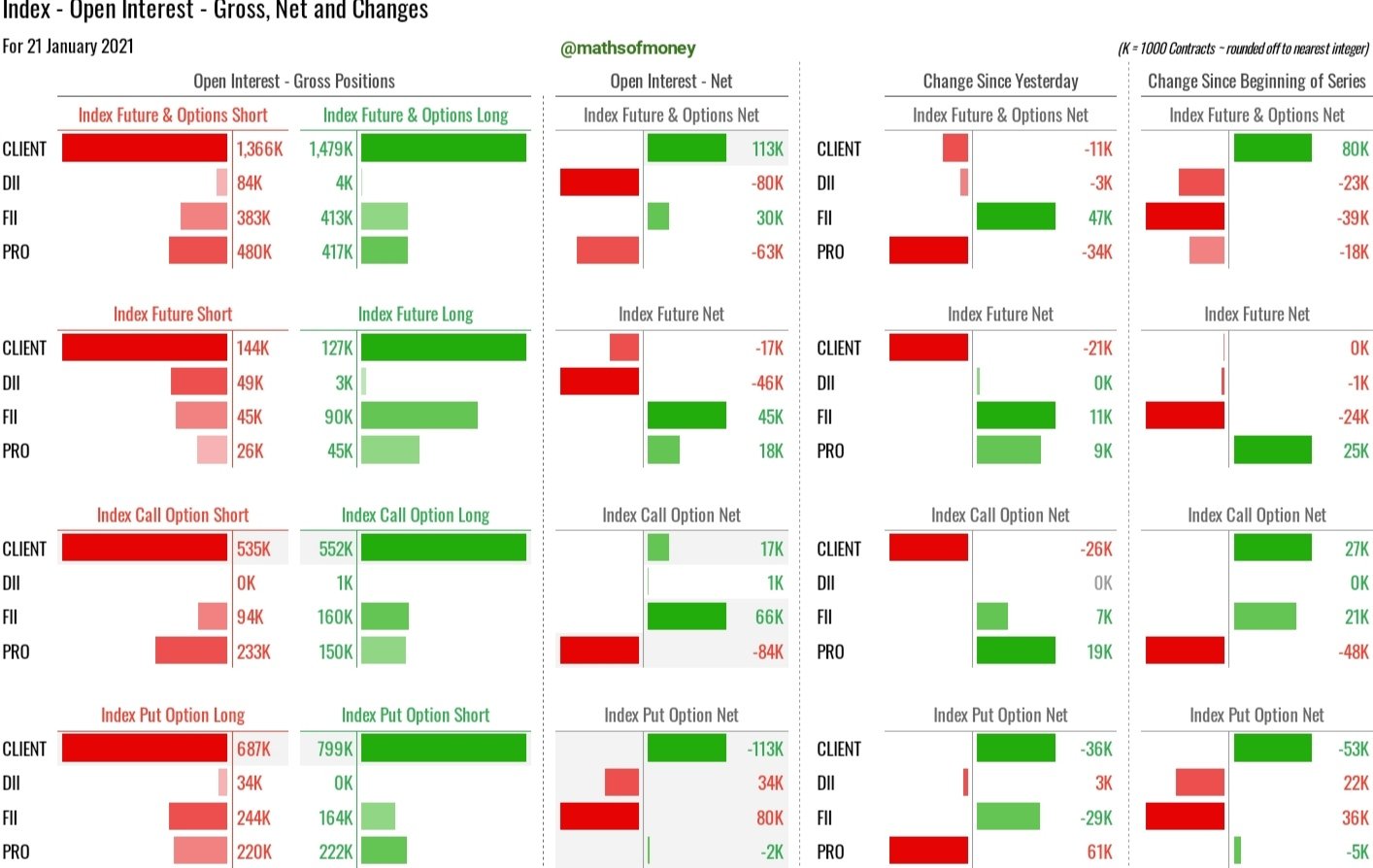

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients have reduced their gross open interest substantially in all index options and had a really dull day as far as stocks are concerned. Gross open interest which was hovering above 1 million has now dropped to almost 75% to a half. This is the final open interest they mean to carry for monthly expiry.

- In this open interest, they are directly set up against FII (80k) and DII (34k) by writing 113k index put options for them. Their net short in index futures of 17k matches with net long in index call options so 113k remain the only long position clients carry which is by way of selling of index put options - earnings limited to premium written and losses are unlimited.

- Clients continue their humongous gross longs in stocks totally to more than 1.6 million contracts almost half of which is stock futures long. As far as gross open interest in stock options is concerned, clients have company from Pro in stock call short (399k) and stock put long (211k), however, stock call long (629k) and stock put short (280k) are the castles they dominate completely. This is also reflected in their net stock call options long (229k) and net stock put options short (68k) and both these are against Pro and FII directly.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII increased their selling in cash market today to above 1,000 Crs. In the derivatives segment, they had a mixed day with 3k short added in indices and 4k covering of shorts in their carried stock futures. Their stance remain largely unchanged.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- As dollar index came under pressure, FII's buying in cash market has picked up over last two days and in derivatives segment today clients swung back to net long in index (30k) and remained net long in stocks (122k).

- Today's carried open interest is primarily for monthly expiry, the most important part is in spite of witnessing sharp fall in indices, FII still continue to carry 80k long in index put options. One may conclude that they expect indices to keep moving down as we grow closer to monthly expiry.

- However, a counter argument could also be that they also carried net long in index call options (66k), that too, in spite of Nifty and Bank Nifty making lifetime highs today. If they expected today's high to be respected they would have looked to unwind and book profits in their calls as well. The fact that they chose to carry means they see further upside.

- To find support for either of these two arguments, we must look at gross open interest by FII in each of index option segments and highest open interest is simply in index put options long (244k). However this is still not conclusive enough to provide comfort as to direction especially since almost daily FII's net open interest keeps swinging between long and short for index.

- The naked longs in stock futures by FII stand at 653k (690k future long minus 37k stock put option long). However there is no significant built up or unwinding is seen in this number by FII over last few days.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Other than minor 9k addition in index futures, Pro covered 19k short in index call options and also covered 61k short in index put options. If they timed it perfectly they could have made money on both these short covering as market provided with handsome two way movement today.

- Interesting part of this short covering was, Pro now has almost no net shorts (2k) in index put options and that makes clients as the only index put writers for monthly expiry.

- To aggregate their stance, Pro stand as only index call writers (84k) for next week and FII are against them as the largest net index call buyers (66k). On gross basis, it's clients open interes in index options that matter the rest are just too insignificant.

- With a rather uneventful day for stock derivatives, Pro continue to stand against clients in stock options play and are supported mildly by FII.

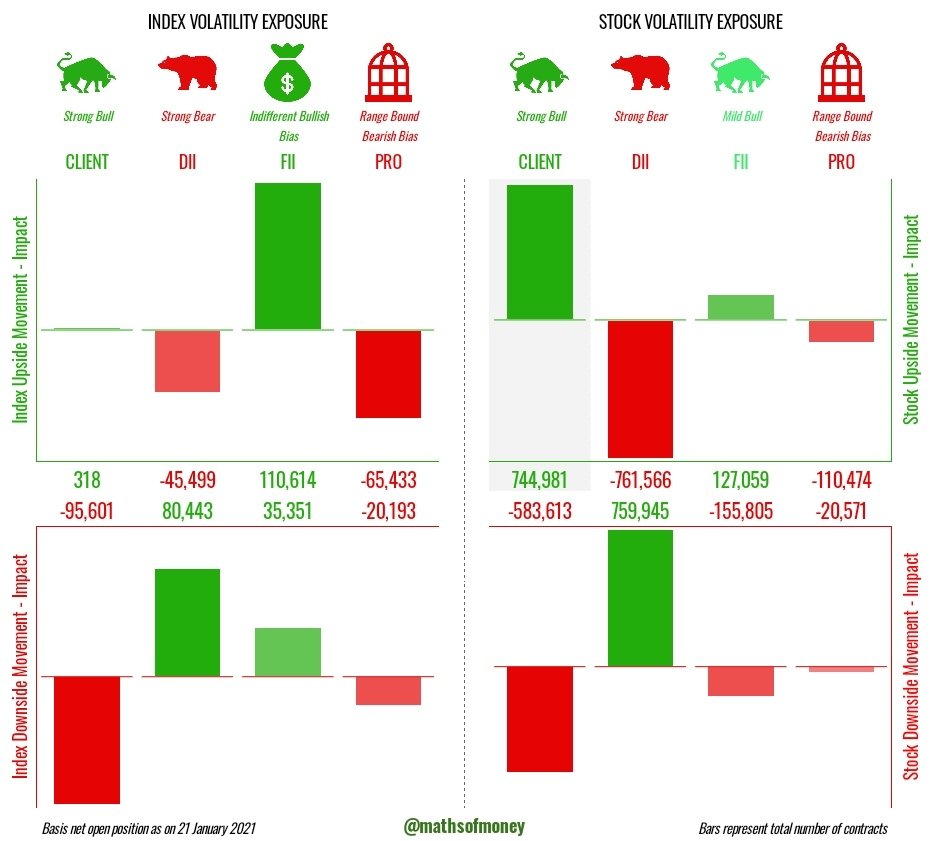

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Even though retail investors reduced some of their longs in index today, they still carry a handsome more than 100k net long. The pity however is they stand to earn nothing on upside of index and happen to be the biggest losers in case index falls. This is where COMPLACENCY is reflecting.

- DII with mild shorts added continue their hedged positions in indices.

- FII remain biggest beneficiaries of rally in indices and inspite of unwinding some of their put options they still earn second best profit on down side.

- Pro have covered all of their shorts in index put options which make them largely interested in keeping indices range bound or lower.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Retail investors still carry huge net longs in stocks, however a third of it is long in stock call options which saves them that much downside exposure.

- FII even though continue to be bullish on stocks, are simply insignificant against the might of clients on net basis, however, as far as gross longs in stock futures are concerned they dominate the bull play.

- DII with a few additional shorts in stock futures are simply looking to encash or forgo full profits on their hedged positions - no play in stock options.

- Pro have the support of FII for their stock option bets which are directly in contrast to clients. Still with 84k longs in stock options, they do hurt a little in case of deep fall in stock prices.

Follow @mathsofmoney

Comments

Post a Comment