Participant Wise Open Interest || 18th Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Please feel free to leave your comments and follow on Twitter in case you want to know more about Participant Wise Interest Interest Analysis.

Follow @mathsofmoney

Participant Wise Open Interest Analysis based on Today's FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: After climbing above 25 briefly, India VIX started contracting however closed at 24.40 ehich is higher than previous close. This means for every buying push the market is getting on intrady basis the counter bets in option chain keep getting in. VIX above 24 is extremely nervous situation for bulls as is, when compounded with other factors, it just becomes unmanageable.

- Dollar Index: DXY is flirting with levels of 91 which was the major support it broke to embark on a downward journey. Against all odds (especially the talks of China withdrawing Dollar peg), USD seems all set to march higher and with it would dry the flow of liquidity to all emerging market equities.

- Oil: With China declaring imoroved production and GDP growth numbers, and other emerging markets expected to follow the lead, Oil looks to gain momentum, however, it is not reflected in the price action at the momentum which is pretty flat.

- Daily RSI: With today's about 1% fall in Nifty, RSI has come under severe pressure and has now reduce to 62.50. As we discussed in previous analysis, once daily RSI closes above 80, index enters into overbought zone. However, untill RSI starts closing below 40, the indicator on its own doesn't indicate trend reversal in stricter terms.

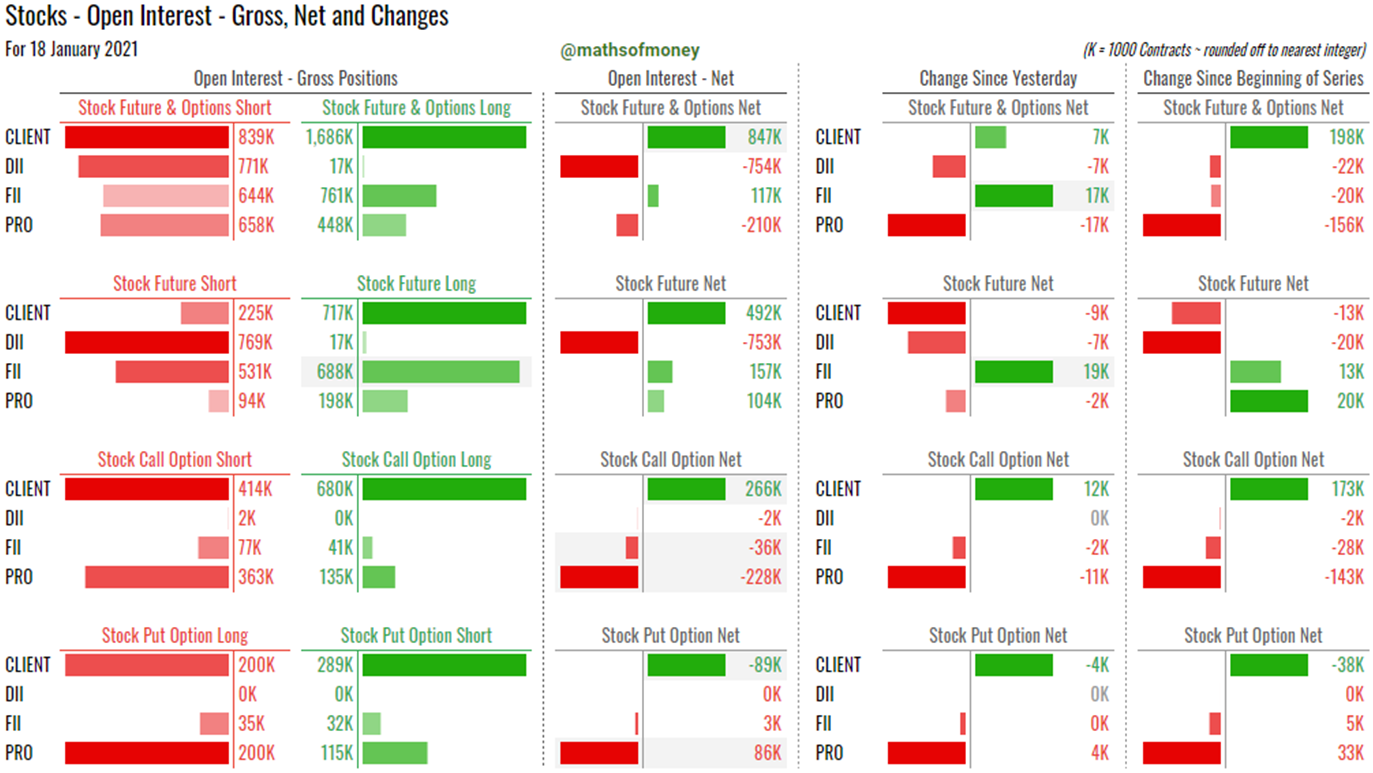

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients (loosely retail investors) keep pilling up longs in index (61k), however, todays majority of longs were relatively safe by buying of index call options (53k) and only 13k were newly written index put options.

- Out of total net long of 294k contracts in index, 261k were acquired in this series which has registered all time high in index this is no co-incidence that the euphoria that was created over last two months has culminated into clients continuing blind buys even though there are no other participants to support them.

- Contrary to last few days, today, for the second time, market failed to hold on to intraday pull back, witnessed fresh selling and closed near day's lows. This however left retail investors long in indices while the rest of the participants remained short and even increased their hedge. This itself speaks volumes.

- Clients even though has a muted day in stock open interest, they still manages to buy 12k stock call options and write 4k stock put options.

- This takes their net open interest in stock options to:

- Stock Call Options Long (266k): These are written by FII (36k) and Pro (228k)

- Stock Put Options short (89): These are bought by FII (3k) and Pro (86k)

- Because stock open interest doesn't necessarily net off (long and short could be in different stocks), just another interesting observation is clients gross longs in stocks (1.686 million contracts) is more than gross long in stocks by FII, DII and Pro put together and on the other hand gross short in stocks by each participants are almost aligned between 650-850k contracts. This simply suggests stocks may continue to erode prices.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII had an uneventful day in cash segment today and kept adding shorts in small quantities both in index futures and stock futures.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- The impact of rising dollar index was seen with reduced fund flow from FII in cash market.

- However, there were no additional shorts by FII in index today and profit in few shorts in stock futures has resulted into net long of 17k by FII in stocks.

- FII carrying net 122k long in index put options (which is in excess of their 40k long in index futures) and not being bothered about time decay in premium pricing indicates that indices may continue to remain in pressure at least till next weekly expiry. Also it's pertinent to note that these index put options are written single handedly by retail investors (181k).

- Stock open interest doesn't necessarily net off, hence, FII's gross long of 688k stock futures might mean they still need some distribution to complete especially because there are no significant gross longs by FII in stock put options to cover for their futures position. Selected stock might still see upside or sideways movement (especially when its coupled with reduction in open interest) which needs to be used to either exit ones longs or create fresh stocks.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro have added 56k shorts today in index which includes additional writing of 58k index call options which takes their total short of index call options to 170k which are bought by FII (49k) and clients (120k).

- With added shorts in stocks again primarily by way of writing of stock call options, Pro are now placed directly against retail investors as far as stock options are concerned:

- Pro have sold 228k stock call options to clients, and

- Pro have bought 86k stock put options from clients

- Remember that Pro started off their option writing as range bound play and have utilised two sided movements to convert their positions as pure bearish play. A classic study for distribution or hand over of longs at and near the top to study for option traders.

- This is all the more relevant as Pro have handed over 156k stock contracts and 141k index contracts to retail investors in the month of January itself.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Retail investors continue to be the only participant to lose, that too big time obviously, against fall in index. There is no other or stronger bulls in indices than clients.

- DII happens to retain full profits against their hedged shorts and thanks to long in index put options they happen to lose only half the upside gains.

- FII puts forward another glaring example for option traders with being biggest beneficiary of any fall in index and remember they were long in index until just last week when index made all time high. Another perfect study of distribution at the top.

- Pro expect to push indices down to encash on their shorts in index call options and also make some gains in index put longs.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients carry enormous amounts of longs both at net and gross levels there cannot be a stronger demonstration to conviction (may be in the wrong direction though). So the more apt analogy is Mad Bull but will be content with labeling them strong bulls.

- FII even though continue to be bullish on stocks, are simply insignificant against the might of clients.

- DII remain largest shorts in stocks which is dismissed as hedge which can soon deliver some profits.

- Pro even though are looking to keep stocks from breaking out, the underlying is their contra position with clients in stock options.

Market has confirmed the "SELL ON RISE" set up today by again trying to recover from intrady low and failing. The important event today in indices was closing below 10 Day EMA. This now has to be followed up by closing below 20 Day EMA to convert into pure play short market.

Follow @mathsofmoney

Comments

Post a Comment