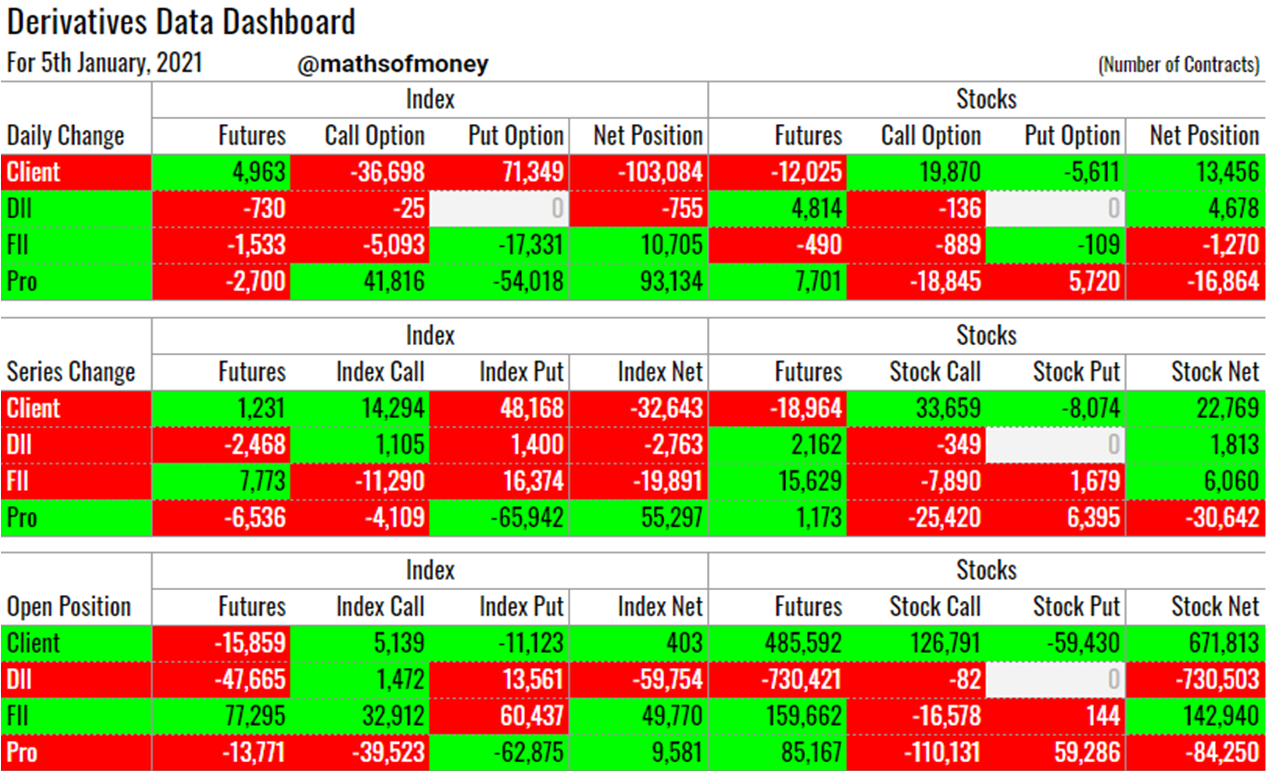

Participant Wise Open Interest - 5th January - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 5th January

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX was very much stable at 20 levels and was not supportive of the fall market saw during the early hours of trade.

- While precious metals saw some traction yesterday, Oil prices are seeing some action today. Remember even with Oil prices under pressure during most of the Q3, India's trade deficit has significantly widened

- Green back has no respite whatsoever, world is punishing for quantitative easing and Dollar Index (DXY) just cant pick up.

- At 77 Nifty daily RSI is approaching 80 while today Bank Nifty RSI has finally crossed over 70 which means both the indices are looking at strong closing for next few days.

Yesterday's Derivative Data Analysis - For Comparison

4th January - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients have booked full profit on their entire net long position in index derivatives by unwinding 103k long contracts in a single day.

- As we saw in yesterday's open interest analysis, retail investors added 70k net longs in first two days of January and today they have unwound these longs along with their carried position from December. This means they booked profits on their longs.

- Going by normal psychology, because retail participation is thin to none in index upside, next few days could see sharp upward movement luring retail investors back in bullish play.

- However, on gross levels Clients still carry highest positions in almost all categories of derivatives and hence there could be surprises ahead. One thing is sure - the movements, on either side, shall be sharp and most likely the first direction of the movement shall be trap.

- Clients, on contrary to their index trades, have added net longs (13k) in Stock contracts mostly both by way of buying stock call options (7k) and selling stock put options (6k).

- This indicates that even though Nifty and Bank Nifty might remain bullish, we will definitely see rotation in the stocks driving them - just like we saw today Kotak, ICICI, SBI, HDFC Bank taking back seat against usual.

- This again is corroborated by the fact that retail investors are net buyers of stock call options of 127k contracts which are sold by the rest of the three participants (mainly PRO).

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Even though DII continues to be a spectator with only participation being hedge on their positions, today they are the only participants with net short position in index. Because this is presumed hedge against their cash market positions, there are practically no shorts on net levels across participants - yet another indication of high volatility in next few trading days.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- With net 11k contracts long in index, FII now carry highest longs in Index on net basis and also the only long (77k) in Index Futures while all the rest are net shorts.

- To add to this, FII are the biggest net buyers of index call options (33k) and index put options (60k) which are written by PROs. This means, if FII were to push market into any single direction sharply, they need to topple net index options written by PRO - a clear FII vs PRO scenario

- There isn't much to discuss about change in FII's open position in stock contracts, except for the fact that if stocks dont rotate and there is across the board bull run, retail investors (612k) tend to make 4.5x more money than FII (143k).

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- As we saw yesterday that PRO had written all the net addition to index call options, today's recovery in the market forced PRO to cover these shorts and book losses. They have looked to over extend this play by writing index put options today and added a net long of 93k in index.

- With the kind of put writing seen at 31k and 14k (7th Jan) during the first half of trading, it can be safe to assume that index put options written by PRO might be of this weekly expiry and could see short covering over next two days only.

- PRO have continued to short stocks and have now written 110k stock call options on net levels.

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- FII are biggest beneficiaries of any upward movement in Nifty and Bank Nifty with small exposure in case of fall

- Clients have completely reversed their stance on index and now end up losing a little in case index moves up

- DII continue their hedge bets - remain strong bears for want of competition

- PRO looking to keep the indices contained at least till this weekly expiry

Stocks Volatility Impact Assessment

- Clients stand to make the most money in case of across the board rise in stock prices

- FII do earn a little in case stocks move up, or, the long positions that clients and FII carry are primarily in different stocks

- PRO are expecting to keep stocks also within the range - a strong case for rotation in top performers

Comments

Post a Comment