Participant Wise Open Interest || 19th Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Please feel free to leave your comments and follow on Twitter in case you want to know more about Participant Wise Interest Interest Analysis.

Follow @mathsofmoney

Participant Wise Open Interest Analysis based on Today's FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: With a single directional move today in the market, India VIX lost much coveted ground of 24 and closed below 23. This means that a lot of option sellers (most likely index calls) were pushed to close their positions with stop losses triggered and premium on index put options decayed with nearing weekly expiry. This however is not the end of worry and as long as VIX holds even at 23 the market may still see sharp turns and twists over next two days at least.

- Dollar Index: Due to the ("absurd" - at the very least) notion of continuing Quantitative Easing dollar felt pressured however DXY is still trading around 90.50 which is continuing to threaten free flow of funds into global risk assets.

- Oil: May be in the waiting for a big news to continue its upwards journey, Oil is resting keeping almost half of last week's gains intact. We do have significant US data coming in tomorrow concerning Oil.

- Daily RSI: Today's fantastic rally helped Nifty daily RSI to reach 69. This simply creates room for further upside to 70-80 unless it again reached the over bought zones basis this indicator.

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients (loosely retail investors) have booked handsome profits today in their index option position which was largely in contrast to FII & Pro.This is a victory for clients to relish. However they would want to book net long in index they carry today (106k) before getting into the boss mode.

- Interestingly clients have increased their gross shorts in index put options from 1 million yesterday to 1.2 million today, would this prove to be yet another smart premium earning by clients or greed that's a tad too much. This is really important because 1.2 million gross short in index put options is the highest open interest even at the gross level by all participants across all instruments of index or stocks.

- Clients could also book profits in their stock put options shorts (18k) and stock call options long (25k), they went ahead and created new longs in stock futures of 17k. With this, they stand unmatched with gross longs of 1.66 million in stock contracts.

- Their contra positions on stock options remain as they were:

- Stock Call Options Long (241k): These are written by FII (32k) and Pro (207k)

- Stock Put Options short (71k): These are bought by FII (3k) and Pro (67k)

- To stress Client's dominance in writing of stock call options its imperative to note that while other participants do have meaning full open interest on gross levels as far as stock call options buying, stock put options writing and stock put options buying is concerned. However, 655k gross long in stock call options by clients are more than all the other participants combined (twice over!).

- As we know stock open interest doesn't necessarily net off (long and short could be in different stocks), 512k is the minimum naked longs in stocks clients are carrying calculates as : Gross long in stock futures (725k) reduced by gross long in stock put options (213k - assumed that all these are against exact same stocks for which they are carrying long in futures). Once we understand the similar working for FII, we might be able to find the juice for bulls in the market.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII had no participation whatsoever in index trades today and shorted additional 13k stock futures. This was despite them selling about 200 Crs worth of stock in cash market. Slowly and silently DII is ramping up hedged proportion of their cash market holdings.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- As dollar index dictated, FII's untamed buying in cash market has come to a halt. Today also their buying in cash market was only 256 Crs. The real question is with no major participation by FII or DII in cash segment and no major longs serviced by them in derivatives segment either, what was the underlying that carried the market today - so decisively?

- FII seem to have booked loss in index put (22k) premium today and coupled with fresh longs in index call options (24k) they end up being mildly green in net index open interest.

- The naked longs in stock futures by FII (the way we calculated for Clients) stand at 653k (690k - 37k - keeping all assumptions same as Clients). This seems to be the only rationale to explain the buoyancy in the market inspite of drying fresh fund flow. However there is no significant buil tup or unwinding is seen in this number by FII.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro were (had for breakfast and lunch by clients today!!!) forced to book losses in 63k index call options written and around 22k index put options long they carried yesterday.

- Interestingly they still carried 107k net short in index call options which are bought by FII (74k) and Clients (32k). So they expect indices rally to be arrested now. They also wrote new index put options (50k) today which means Pro are all prepared to go back to their range bound view point.

- Pro booked profit by unwinding net long in stock futures by 15k today and also covered 21k short in stock call options. So on daily basis, they booked net losses on winding of their 18k stock put options long. In spite of this, Pro still happen to be the largest sellers of stock contracts (132k) in the month of January (needless to say who bought these!).

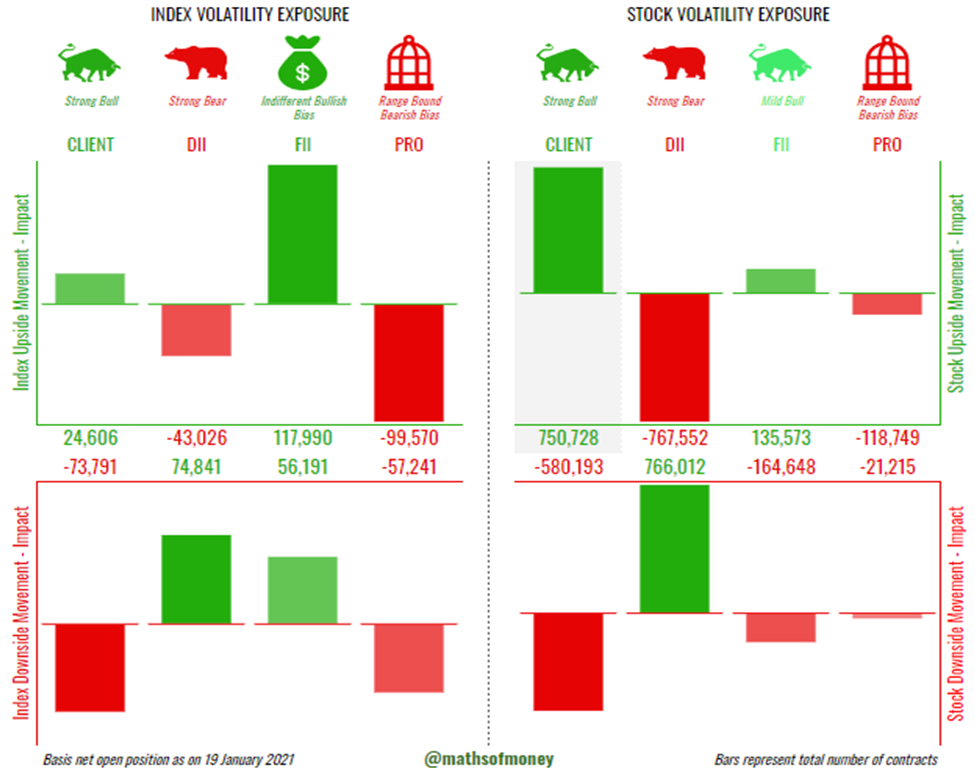

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Even though retail investors booked some profits on their ripe index option trades they continue to be hardest hit in case indices move down.

- DII haven't traded at all in index today and hence they continue to retain full profits against their hedged shorts and thanks to long in index put options they happen to lose only half the upside gains.

- FII remain biggest beneficiaries of rally in indices and inspite of booking some premium loss in their put options they still second best profit on down side.

- In spite of being forced to cover their shorts in index options, Pro still retail firm option writing on both the sides expecting index to remain sideways.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Retail investors still carry huge net longs in stocks, however a third of it is long on stock call options which saves them that much downside exposure.

- FII even though continue to be bullish on stocks, are simply insignificant against the might of clients.

- DII added significant shorts in stocks as compared to few really muted sessions and are clearly looking to encash or forgo full profits on their hedged positions.

- Pro are still holding onto their against the trend bets in stock options hoping for contained month or two ways movement giving them opportunity to switch sides.

Even though nothing has changed in terms of open interest significantly, today's sharp rally can only be explained away by acknowledging the might of retail investors. The question is how long will they remain in charge and would they be given sufficient notice of any change in the regime?

Follow @mathsofmoney

Comments

Post a Comment