Participant Wise Open Interest || Yesterday's Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Please feel free to leave your comments and follow on Twitter in case you want to know more about Participant Wise Interest Interest Analysis.

Follow @mathsofmoney

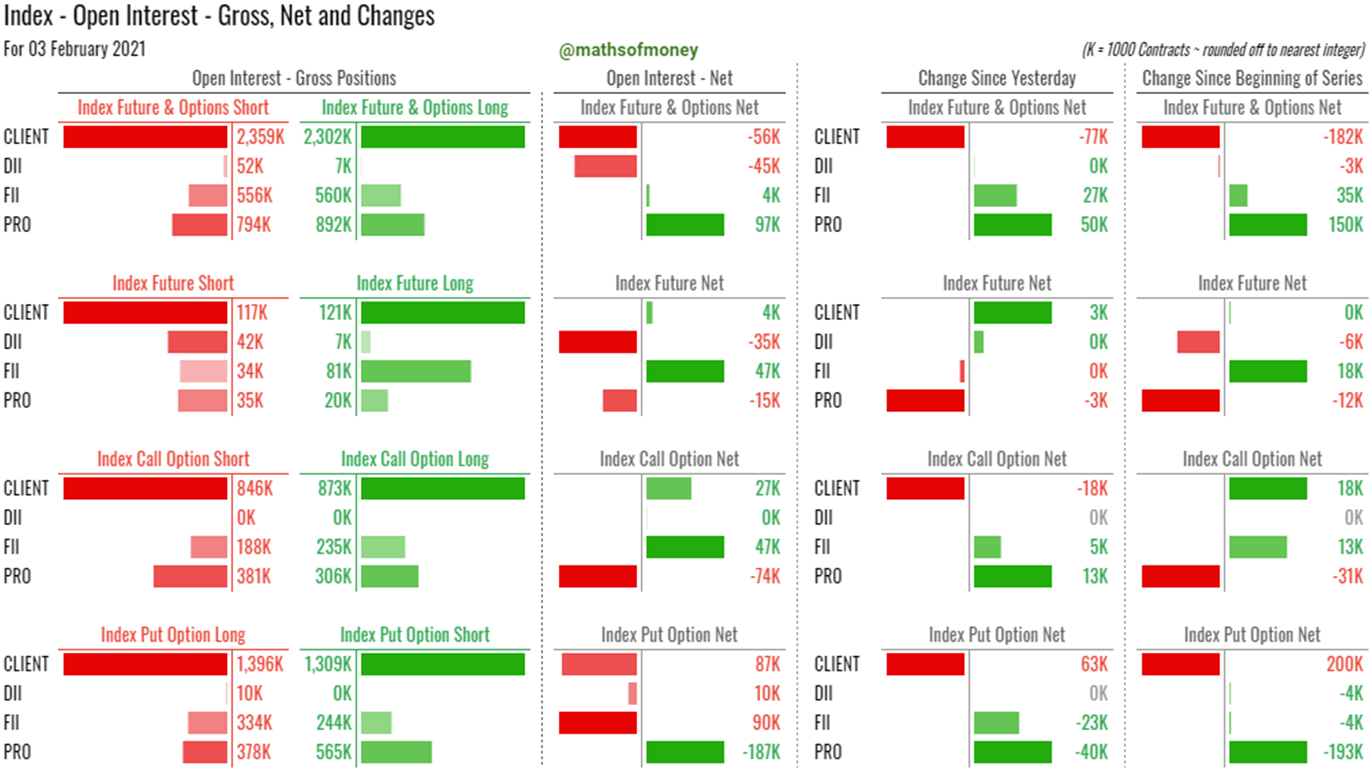

3rd February - Participant Wise Open Interest Analysis based on FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: Volatility is not ready to subside. India VIX closed just below 24 after spending quality time above this level during the day. Two days are already allowed for budget to sink in with investors and tomorrow is weekly expiry, be prepared for a bumpy ride for tomorrow.

- Dollar Index: Retesting 91, dollar is continuing it's consolidation/ upwards march to 92. DXY above 92 brings in catastrophic impact on emerging equity, the last demonstration of that was in September 2020. Unexpected higher employment data only adds fuel to the fire.

- Oil and Precious Metals: Oil has resumed it's upward journey. Oil increasing and Dollar strengthening are two things you dont want to see if you are a bull in Indian markets. These macro, however, have lost their charm against the fund flow in recent times.

- Daily RSI: Bank Nifty is within the striking distance of the psychological level of 35,000 and daily RSI 71 affords enough room for it to breach that level and gain some more. Nifty daily RSI however has still not entered 70. This kind of divergence between the two indices is generally respected by Bank Nifty, so one may expect Bank Nifty to wait for cues from Nifty.

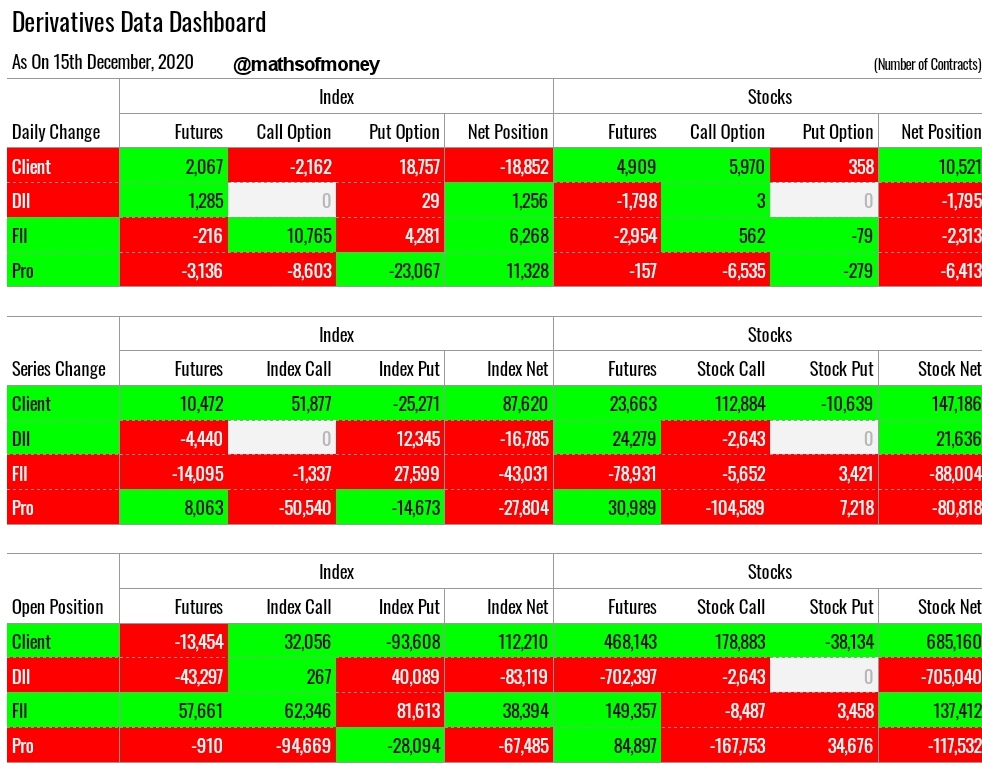

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients (SMARTLY retail investors) have largely abstained from building OI in index or stocks futures and concentrated their play on options, primarily index options.

- With adding 63k net put longs and unwinding 18k shorts clients have now turned net bearish on indices.

- Even though net OI of Clients is slim in indices their gross open interest continue to amaze at more than 2 million both sides.

- In stocks also clients built up was focused on options with adding 10k longs in stock call options and 5k long in stock put options.

- Clients continue to be official put writers of stocks and THE ONLY net long on stock call options. They lop sided OI in stocks is visible even at gross levels with them holding 1.3 million gross longs and 600k gross shorts. Against this FII and Pro are fairly balanced.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII being biggest bears remained in hibernation in derivatives as well as in cash segment.

- Cash market sales of only 400 Crs and covering of 4k shorts in stocks are the only contributions of DII in the market today.

- Day fairy ruled by FII pumping in money unchecked.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- FII has bought a nice 2,500 Crs in cash segment and unwinding of 23k index put longs (showing as negative 2,000 Crs in index put options) were the highlights of the day.

- We still don't see substantial ramp up of open interest in stocks to pre-empt MSCI rebalancing announcement due on 9th of this month.

- Yet another participant for the day with ZERO change in index futures open interest. Nifty and Bank Nifty OI are being treated as "sands and snows" for last two days inspite of continuing rally.

- On index options front, FII finally unwound 23k net longs in puts and added 5k net longs in calls, both bullish built-up and depending on whether this was done during first 10 minutes of trading or not they either gained or lost on them.

- Even after this unwinding they are still carrying 90k net longs in index put options which were built around a week back and provided them more than generous profits for atleast four of those days.

- FII also reduced their gross longs in stock futures and increased their gross shorts in stock futures to take the total net unwinding of longs in stock futures to 10k contracts.

- With little to no change in stock options OI, net reduction of 11k longs in stocks in how FII ended their day today. A long shot attempt to connect this to market movement, continuous price rejection in Nifty around 14860 for an hour and a half starting from 1:00 pm could have concluded with this unwinding and if so a perfect distribution case.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Bowing to the buoyancy of the market, Pro have covered 13k short in index call options and added 40k new shorts in index put options taking their total net longs for the day to 50k in indices.

- Now they stand 97k net long in indices and unfortunately it comprises of only option selling and hence a very high risk exposure. 187k total net puts written, even though seems like an opportunity well grabbed, the fact that they have been pushed to cover their positions more often than not remains a concern.

- In stocks however, Pro reaffirmed their bearish stand in options OI built up by selling 7k fresh calls and buying 5k fresh puts. With all that, they now stand short on 128k stock call options which are bought by clients. Both keep building up the OI waiting for the other to blink first.

- This contest is a lot more direct in stock put options though with retail wiring put options for Pro after adding on to it today.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients have leaned to bearish side with bulk addition in indices put longs. They however continue to earn on upside also.

- DII's are unchanged in their hedged positions on indices and a third of those are option play with no upside loss.

- FII are the BIGGEST BENEFICIARIES of upside in indices and large net longs in index put options gives them a piece of pie on lower side also.

- Pro are exposed to loss either side and the biggest concern is their quantum of exposure, especially on lower side of indices, is highest ever seen by any participant in a long time.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Retail investors now have upside on 700k contracts which is only increasing with every increase in the market.

- DII are the only bears in stocks simply on account of their huge cash market position, a small portion of which stands hedged as short in stock derivatives.

- FII's while still holding heavy gross longs in stock futures are fairly covered in their exposure on net basis but still continue to be mild bulls only.

- Pro are expecting to keep stocks also from running away either side. Their first choice however would be on the lower side as they have collected a little too much premium already on the call options.

Yet another day of flying markets but no significant increase in net carried open interest by any participant. This tells us that be limited to intraday trades, avoid positional trades and stop loss is your best friend.

[This is repeated because it remains relevant]

I am privileged to have readers who are well informed, technically sound and fairly active in the market. I know it's not a cake walk to tolerate my long blah everyday and especially when you navigated the whole article and reached here, it gives that you are an avid (tolerant) reader. However, market needs one more ingredient for a perfect flavor which is reading psychological play also. Therefore it seems pertinent to bring out a psychological aspect which I have observed over last two days with the FITTEST TRADERS (to my belief). These are the most conservative lot - never seen them take any trade without Stoploss and always keen to cut down losing trade first. This lot I believe is the fittest to survive all weathers of the market. These, for last two days, are now saying - "prices are always coming back to our levels, we must not bother with correction that much". This is an eye catching phenomenon for me that I how market can manipulate psychology of traders to its advantage. I am not at all failing to recognise the flow of funds, sky rocketing fundamentals and vibrancy of our economy. In fact, I believe Indian economy is at its best and the growth expectation is such that current PE levels will be more than justified by FY22 earnings. No doubt. However, this turn in the psychology of traders is troubling me and is advising me to become most cautious even though we are right in the middle of the best bull run of our life times, this is also in part because of what a wise man said about when to be greedy and when to be cautious. The operative word here is to be CAUTIOUS, not in denial or negative. Keep riding the trend that's what you are here for. However, ensure to adhere to stricter and tighter stop losses for your trades just to honour the psychological play. Not that the market is not kind, but when does it let the euphoria settle and ask us to brace before a nose dive?

Follow @mathsofmoney

Comments

Post a Comment