Participant Wise Open Interest - 31st December - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 31st December

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX remained at 21 levels

- Dollar Index (DXY) kept struggling to claw back above 90 levels, however, due to lower volumes of holiday season there were no meaningful movements

- Nifty daily RSI climbed above 70 which indicates possibility of further upside in the index

Yesterday's Derivative Data Analysis - For Comparison

30th December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) booked profits in their index call option longs fully and index put option shorts partially and created net shorts in index by about 52k contracts for the day. However, they carried forward their 33k index long contracts into January series.

- In Stock contracts clients booked small profits by selling stock futures and stock call options they have been carrying. Also by adding shorts in stock put options they strengthened their bullish position in stocks. The most important data point is clients carried 650k long in stocks into January Series out of which 111k were added in December.

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII booked losses in their hedged position of Index Put Options by 42k contracts and carried almost half of their previous series shorts in index to January.

- In stocks however, DII's position closes almost flat for December and they carry the similar short quantity in stock futures (assumed as hedged against their cash holdings) into January as they carried in December.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII booked profit in almost half of their index call options and carried the balance half into January which indicates FII remain bullish on index in January. Also, they reduced their put options to 44k by booking losses for 70k put options and added longs in index futures for January series. All these data points put together we can assume FII is still expecting Nifty and Bank Nifty to continue their upward journey.

- FII unwound 89k longs in stock contracts which were handed over (distributed to) retail investors in December. Now, FII carries only 136k net long contracts in stocks as we enter January series.

- With Index expected to be upwards and unwinding of long in stocks, we may expect stocks in uptrend to keep rotating during early part of January and once the distribution of longs to retail is complete, we may expect market to start retreating which shall also be evident from change in their positions in index contracts as well.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO have maintained range bound positions in index during the later part of December series. They could very well book profit from their index put and index call shorts on the last day of approximately 93k contracts, however, they carried 35k shorts in index call options into January. This along with, newly added shorts in Index futures, make PRO net short in index at the beginning of January. This contradicts with FII stance and hence could result in volatility during the initial period of January.

- Even though PRO traded net 27k contracts long in stocks, their open position on the beginning of January is 84k long in stock futures met by similar short in stock call options. This means even though PRO expect stocks to go up in early part of January, this upside is expected to be sold into and hence they want to take advantage of higher call premium due to euphoria in the market. This coupled with 53k long in stock put options indicate PRO are accumulating cheap put options which are likely to deliver good profit by the end of January. This scenario ties up with FII's trade in stocks.

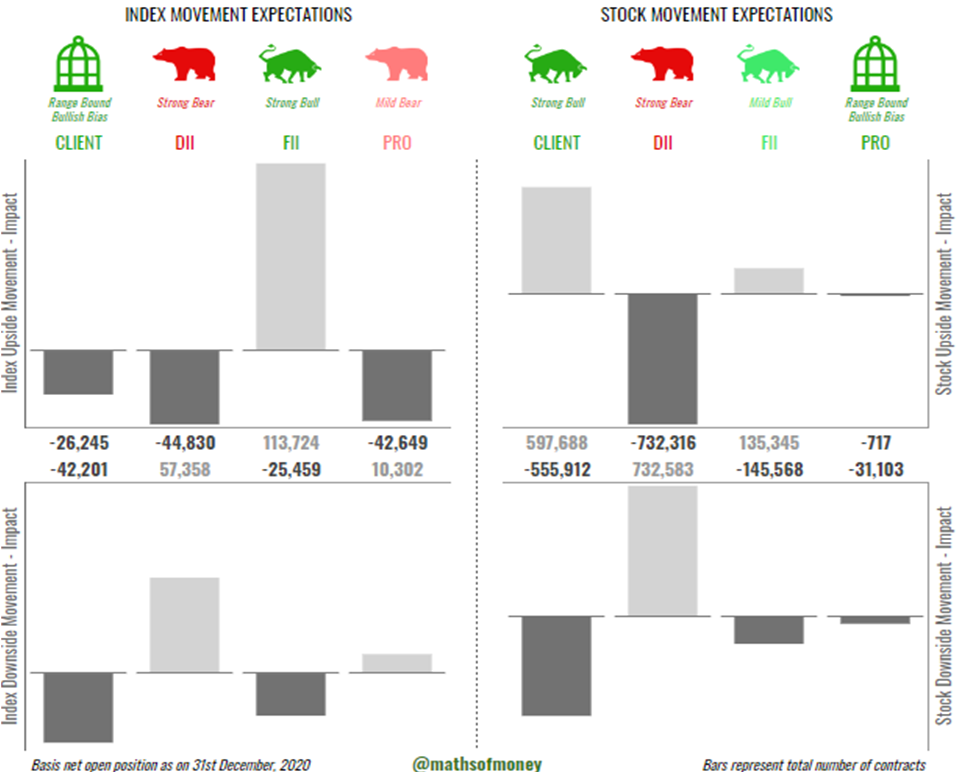

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- FII remain only gainers in case index moves up - strong bull

- Clients expect market to remain range bound by being shorter of call and put options both

- DII continue their hedge into January

- PRO are now playing for index to fall rather than a range bound movement

Stocks Volatility Impact Assessment

- Retail investors carry highest long positions in stocks - strong bull

- FII retained 60% of their longs in stocks - mild bears

- DII continue their hedge by way of short in stock futures

- PRO expect limited moves in individual stocks in January

Comments

Post a Comment