Participant Wise Open Interest - 1st January - Daily Analysis of Derivative Data - CLIENT (RETAIL) FII DII AND PRO - Index and Stocks - Futures, Call Options and Put Options

Participant Wise Open Position Analysis - 1st January

Welcome to the daily analysis of Participant Wise Open Interest Derivative Data including day end participant wise open interest, daily trades (daily change) and series change in derivatives of Index (covering Both Nifty and Bank Nifty) and Stocks with breakup of trades in Index futures, Index call options, Index put options, Stock futures, Stock call options and Stock put options for each category of participants.

Before we proceed with today's derivatives data, let us understand few global / macro factors which affect the market:

- India VIX fell significantly to close around 19.50. This is strong indication that the market remains resilient.

- Oil prices again remained muted without any significant moves.

- Dollar Index (DXY) shrugg off continuing pressure due to Brexit and QE and tried to clinch 90 levels, however, if failed closed just below 90.

- Nifty daily RSI reached 73, this again indicates that index could fly higher and there shall be no pressure on RSI front unless it reaches 80.

- With the month of January, 2021 we are near Q3 results season which will be immediately followed by Union Budget which is promised to be "THE BEST BUDGET IN A 100 YEARS". Market always factors in these things in advance so if there is no trend reversal during first week of January we might see the market climb the wall of worry - Budget in the same bullish mood.

Yesterday's Derivative Data Analysis - For Comparison

31st December - Dashboard

Today's Participant Wise Open Interest

Here are key highlights for today:

Analysis of Clients Trades in Index and Stock Contracts:

(Net trades by Clients in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- Clients (Retail Investors) have continued their bullish trades for Index today by creating 60k net long positions in index contracts.

- There are more alarming numbers on clients trades at gross levels especially Index Put Options. Clients have written 859k index put options out of total 1,214k index put options written. Against this clients remain largest buyers of put options also with 767k index put options long. This might indicate bear put spread strategy making a host of assumption. In spite of this, this level of put writing exposure on index by retail investors is continuing indication of complacency.

- In Stock contracts retail investors added 15k longs mostly by way of buying of 13k stock call options. Even though with only 2k writing of stock put options, clients added their short in stock put options and increased it to 53k.

- Now retail investors are carrying largest long positions both in index (93k) as well as in stocks (664k).

Analysis of DII Trades in Index and Stock Contracts:

(Net trades by DII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- DII had a continuation of their hedging strategies with buying of index put options and selling stock futures.

Analysis of FII Trades in Index and Stock Contracts:

(Net trades by FII in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- FII have almost halved their longs in index derivatives by shorting 36k index contracts for the day. Out of this, 25k was by way of buying of index put options increasing their total index put options long to 69k against their index futures longs of 67k. This hedged FII's index futures positions completely against any fall.

- FII, in spite of expectations of thin participation in the market due to global holidays, have bought 6k stock futures and against this have sold 4k stock call options resulting in net long in stock contracts of 1k.

Analysis of PRO Trades in Index and Stock Contracts:

(Net trades by PRO in Index Futures, Index Call Options, Index Put Options, Stock Futures, Stock Call Options and Stock Put Options):

- PRO were aggressive sellers for the day in Index (23k) and in stocks (10k).

- With additional selling of index call options (20k) and stock call options (8k) for the day, PRO are now official net call writers of index and stocks. While we saw that retail investors are official net writers of index put options and stock put options.

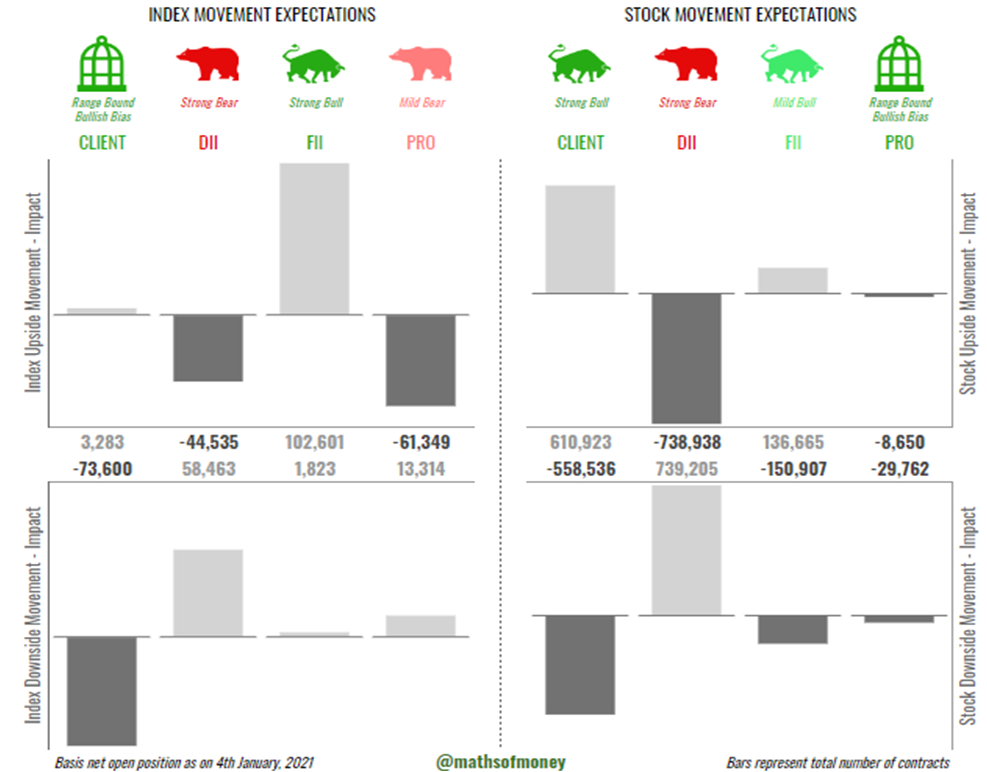

High Volatility Impact Assessment for Open Interest in Index and Stocks Derivatives

(Risk exposure for each participant - Client, FII, DII and Pro in case market sees high volatility in either direction):

- Each participant even though has net index or stock position which is shown as long or short, the composition and characteristic of these are fairly different, imagine a long position by way of buying of call options versus a long position by way of selling of put options. Risk and reward substantially differ even though both are long positions

- To account for this, we have prepared High Volatility Impact Assessment reflecting how many positions actually carry unlimited downside or upside risk for each participant in case of extreme one directional move in the market.

- Here is today's derivative data high volatility impact assessment:

Index Volatility Impact Assessment

- Retail investors are carrying highest long position in index and this is by way of shorts in index put options. Their trades keep demonstrating the euphoria or complacency.

- FII are now carrying only half of their longs in index. And they are net buyers of index call options and index put options.

- DII continue their hedged position in index.

- PRO are the aggressive shorters of index derivatives.

Stocks Volatility Impact Assessment

- Retail investors are carrying highest long position in stock derivatives and they are the net writers of Stock Put Options.

- FII also remain bullish on stocks with much lower net long positions.

- DII have increased their shorts in stocks and its a naked sell of stock futures.

- PRO are the aggressive shorters of stocks also with writting 93k stock call options.

Comments

Post a Comment