Participant Wise Open Interest - 8th January - FII DII CLIENT AND PRO - Nifty OI, Bank Nifty OI, Change in Nifty OI

Participant Wise Open Interest Analysis - 8th January

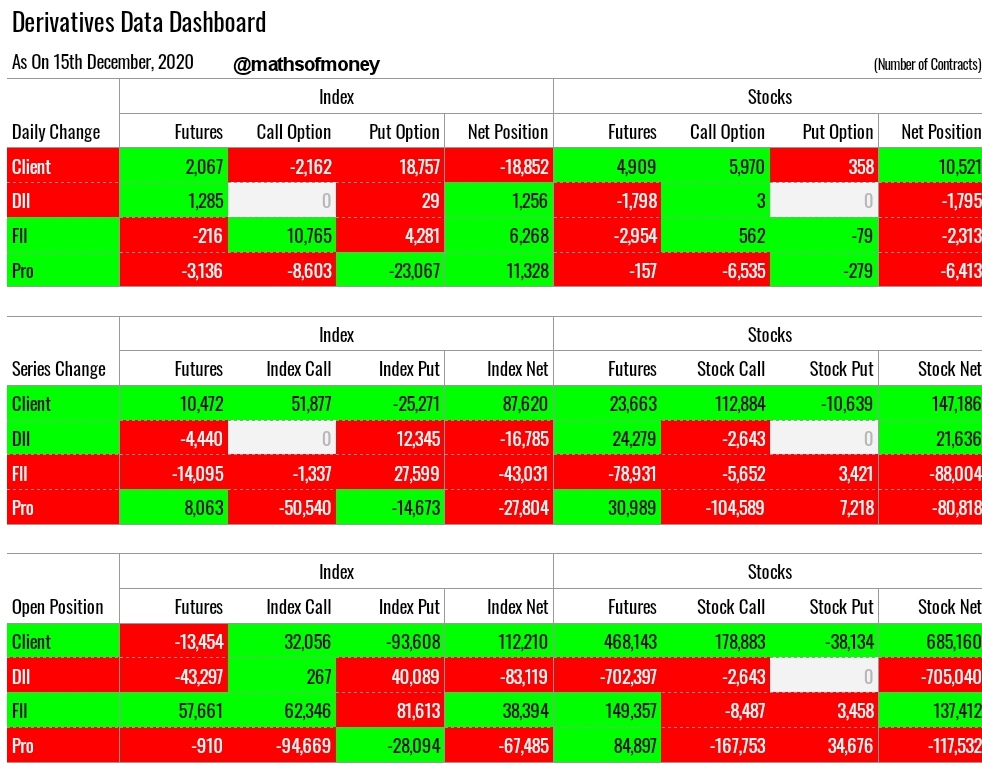

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).

Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted in "EXPOSURE TO VOLATILITY"

- FII, DII, Clients and PRO - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO - Exposure to STOCK VOLATILITY

1. Macro & Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: India VIX remained almost flat at 20.60 which is a typical premium decay ploy on a Friday when premiums are priced highest for next weekly expiry.

- Dollar Index: With US political situation getting resolved, USD started gaining momentum and has finally after nine days DXY closed just above 90. This must start reflecting on drying up liquidity and USD / INR pricing in the week to follow.

- Oil: Oil continued upward march with more than 3% gains now the technical breakout on Oil is confirmed which opens it up to much higher levels, again correlating this with mad rally in stocks like Asian Paints and Pidilite which have oil as their biggest raw material. If not shorting, its time to book profits in such counters if you carry any.

- Daily RSI: Sharp closing rally has pushed Nifty daily RSI to above 77 and 80 is the level when longs will definitely look to book their profits or cover their positions. Inspite of remaining under pressure the whole day, Bank Nifty RSI improved marginally to almost at 73. So if the market is to remain buoyant next week, Bank Nifty will have to lead the charge.

2. Participant wise open interest data

Yesterday's Open Interest Analysis - For Comparison

7th January - Dashboard

Today's Participant Wise Open Interest - Index Charts

[NEW REPRESENTATION - INCLUDING GROSS OPEN INTEREST NUMBERS]

Today's Participant Wise Open Interest - Stock Charts

[NEW REPRESENTATION - INCLUDING GROSS OPEN INTEREST NUMBERS]

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Clients have unwound 64k net long position in the index by way of booking profit in 32k net short in index put options and short built up of 10k index future and 25k index call options.

- The most fascinating part of today's data is increase in total open interest in index put options buy and sell side by clients with more than 250k contracts in a single day. To stress the magnitude - this single day addition, is more than TOTAL open position carried by each of the other participants in individual instruments. Same is the case in index call options with a towering single day addition in open interest of almost 180-200k contracts.

- This pushes me to make the statement - "INDEX IS NOW A DEMOCRACY"

- In spite of unwinding 27k stock contracts, Clients remain largest net long in stocks. There is next to none involvement of any other participant in stock put options writing which is duly reflected with clients being net stock put writers for the market. Clients also are the only net stock call option buyers.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII have bought 6k index put options and covered 6k stock futures short.

- With no significant change in any of the individual instrument positions they seem to be simply adjusting their hedge.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- FII have added 32k longs in net index open interest which includes 11k longs added in index futures. With this addition, FII now carry second highest longs in index futures (114k) just next to retail (125k). This is the only impact full / significant position FII carries across all the stock instruments and that makes FII the only net buyers (88k) of index futures.

- In spite of carrying highest net long in index (73k), FII's open interest stand nowhere compared to open interest clients carry in index future short, buy or sell of index call options and buy or sell of index put options. Therefore, we have declared Index as a democracy from today on wards.

- With 9k added longs in stocks FII continue to be second long in stocks after clients with 147k net stock futures and options long. In this, stock call options and stock put options have insignificant open interest and net impact. The real play FII carries is in stock futures.

- 687k longs in stock futures (highest among all participants) and 518k shorts in stock futures (second highest after DII) means that stock rotation is here to continue. Also its important to note that the short in stock futures by clients is only 212k. So we can reject the claims in media "TOO MUCH SHORT BUILT UP" as a reason for select stocks to keep moving up. The real reason is 687k longs by FII are yet to be distributed / unwound.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- With covering of 38k shorts in index for the day, PRO are now 21k shorts on index futures and options, however, they do not have any significant open interest across all index instruments. Anyways we already know that index is the turf that belongs entirely to retail now.

- In spite of covering shorts (12k) in stocks for the day, PRO remain 106k net short in stocks which includes a net 142k stock calls written by them. This, even at gross levels, reflects as second highest stock call writing (255k) including all the open interest in stock calls at the end of the day.

- Also with highest net stock put buying (58k), PRO are second highest stock put buyers (147k) for all stock put options just a tad below retail.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY :

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients in spite of having conquered index, are playing for it to remain range bound. This is the chaos that comes with democracy.

- FII are the only beneficiaries of long and the easiest way for them to achieve this is through their 114k longs in index. So we may expect Nifty and Bank Nifty to continue their upward journey.

- DII continue their hedge bets - remain strong bears by standing to gain the most in case of fall

- PRO at net levels expect for the market to remain range bound. However, because their gross participation is negligible on index levels, its only going to be FII and Clients deciding the fate of index.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients are long across the board in stocks, however, the number that matters is their 683k future longs and just 212k future short

- FII also are looking to keep stock prices up with 687k longs in futures however their 518k shorts mean the rotation will continue

- DII remain largest shorts in stocks which is dismissed as hedge

- PRO's only meaning full participation is bearish movement through gain in their stock option positions once they exit their stock future longs.

Please feel free to leave your comments and follow on Twitter in case you want to know more about Participant Wise Interest Interest Analysis.

Comments

Post a Comment