Participant Wise Open Interest || 14th Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Follow @mathsofmoney

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

Now let us discuss this numbers in detail.

Follow @mathsofmoney

Participant Wise Open Interest Analysis based on 14th January FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: Even after weekly expiry, India VIX remained above 23. This level of volatility at the beginning of weekly series and with only two weeks for monthly expiry means next two weeks are going to be choppy and above 24 India VIX definitely makes bulls nervous. Time to re-evaluate your positional trades for sure.

- Dollar Index: Green back is definitely gauning momentum with DXY standing strong just above 90.50 and that too inspite of continuing political drama of impeachment. Now that Jobless claims (both intial and continuing) have disappointed and the depth of fed's pocket is running out, it might be time to run back to risk averse assets for global investors which will simply write death warrant for continuing liquidity for emerging markets equity.

- Oil: Oil is taking breather after a short rally of around 10% is this a sign for longer steeper rise to follow?

- Daily RSI: Nifty managed to close with dailt RSI above 81. This has happened five times in last two decades (Nov-02,Jan-04, Apr-06, Oct-08,Sept-10,May-14) and every time RSI has come back to test 40 or below in 3-6 months time. So complacency is the luxury we cant afford anymore.

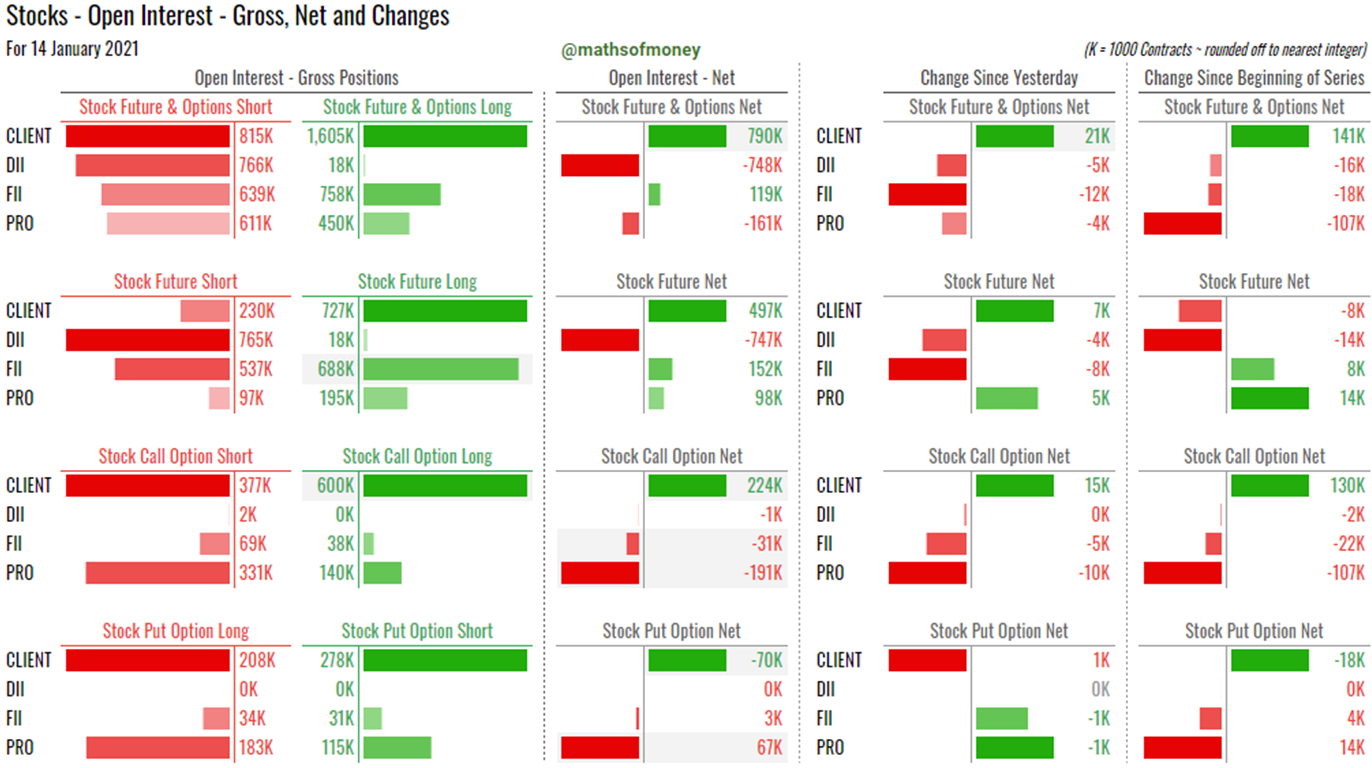

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

Today's Participant Wise Open Interest - Index Charts

Today's Participant Wise Open Interest - Stock Charts

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Even though clients unwound 31k of their longs in Index, apparently of weekly expiry, they continue to carry net longs ij access of 100k.

- Clients continue to be the put writers for indices, now net index put options short are 117k and on gross levels total shorts in index put options by clients are almost a million contracts.

- Understandably with the kind of Euphoria persists in the market, however, one may participate by way of buying calls or even going long on futures, however, this magnitude of put writing is reflecting COMPLACENCY on the part of retail investors, exactly the kind one would not want to indulge into given other macro factors discussed above.

- Clients have added 21k fresh longs in stocks, even though most of it is by way of buying calls (15k) which is fairly safer bet, the bar of total net long in stocks by retail investors is ever rising and now stand at 790k contracts.

- The two front battle of retail investors on stock options front continues:

- Stock Call Options: Clients have bought net 224k stock call options; these are written by FII (31k) and Pro (191k)

- Stock Put Options: Clients have written net 70k stock put options; these are bought by FII (3k) and Pro (67k)

- The question is can clients keep buying and supporting stocks or they expect liquidity flow to continue in order to earn from this complacenct trade set up they have got themselves into?(A rhetorical question, by the way)

- Just the 600k total long by clients in stock call options are enough to conclude that the stock rotation will continue till FII are done parking their longs in stock futures.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII had no participation in index trades for today and 5k short in stocks in line with what we have been seeing over last few weeks. Their cash market numbers were also quite subdued with only 180 Crs of sale.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Today FII have infused approximately 1000 Crs in cash market, with no matching sale by DII, the net inflow in the market was around 800 Crs in cash segment, however, NSE had negative breadth today.

- Even after weekly expirty play is over, FII still carries 95k net long in index put options. Is this a give away to clients as they are the writers of these put options. On the other side, FII are also net buyers (62k) of index call options which were primarily written by Pro.

- In fact, FII's open interest now in indices is composed in such a way that they would end up booking profits irrespective of market movement, having taken full advantage of two sided movement in indices we have seen over last couple of weeks.

- On stocks front, FII have rolled down 12k longs today most of which by way of reducing longs in stock futures.

- On gross basis also, FII has slim participation in stock options, however, they longs of 688k stock futures continues to remain the focal points for bulls now.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro continue to be active primarily on collecting premium on options left right and centre. As the movement in indices were quite dull for the day, Pro's net long in indices of 20k is simply their profits booked in written index call and put options.

- Interesting number is Pro are now entering new weekly expiry with 55k short in index call options which are bought by FII. On the other hand concentrated short in index put options are by clients at 117k. Therefore, whichever participant are forced to cover their shorts this week, we might see indices moving sharply in that direction, same is suggested by India VIX.

- On stock options front, Pro have direct contest with clients and is suggestive of either a correction or stock rotation, there seems to be no indication for a full blown rise in prices across the breadth of the market.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients continue to be in miserable position with taking highest losses in case of fall in indices and also making some losses in case of index moving higher.

- DII are hedged smartly and happen to lose half in case indices go up and earn double in case indices fall.

- Even though FII's best interest still lies in keeping the indices up their perfect hedge by buying index puts at right times have now made them indifferent.

- Pro are set to keep indices from breaking out for the week and make no significant gains on the downside either.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients do carry naked longs in stock futures and hence end up earning the most in case stocks move up especially with their 600k longs in stock call options.

- FII have covered significant portion of their longs through buying of stock put options and we know FII are not the kind to pay premium (for buying options) unless its worth it.

- DII remain largest shorts in stocks which is dismissed as hedge.

- Pro even though are looking to keep stocks also from breaking out, the underlying is their contra position with clients in stock options.

Follow @mathsofmoney

Comments

Post a Comment