Participant Wise Open Interest - 7th January - FII DII CLIENT AND PRO - Nifty OI, Bank Nifty OI, Change in Nifty OI

Participant Wise Open Interest Analysis - 7th January

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).

Sections of this analysis:

- Macro & global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted in "EXPOSURE TO VOLATILITY"

- FII, DII, Clients and PRO - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO - Exposure to STOCK VOLATILITY

1. Macro & Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: As expected on the day of weekly expiry, India VIX fell from 21.50 to close at 20.60. Still maintaining above 19.

- Dollar Index: The last 30 minutes sharp fall in Nifty could be attributed to Dollar Index (DXY) marching up to 89.96. Even though it couldn't cross over 90, now that last of stimulus news is done and dusted with, might be the time for Dollar to show some strength.

- Oil: With news of falling Oil inventories, Oil prices found some momentum however they still haven't run away.

- Daily RSI: Even though Nifty closed below yesterday, Nifty Daily RSI maintained the critical level of 70 and closed near 73. Bank Nifty Daily RSI marched upwards to 72. Both the indices have momentum to back them to go further up.

2. Participant wise open interest data

Yesterday's Open Interest Analysis - For Comparison

6th January - Dashboard

Today's Participant Wise Open Interest - Table

[EXISTING TABLE FORMAT]

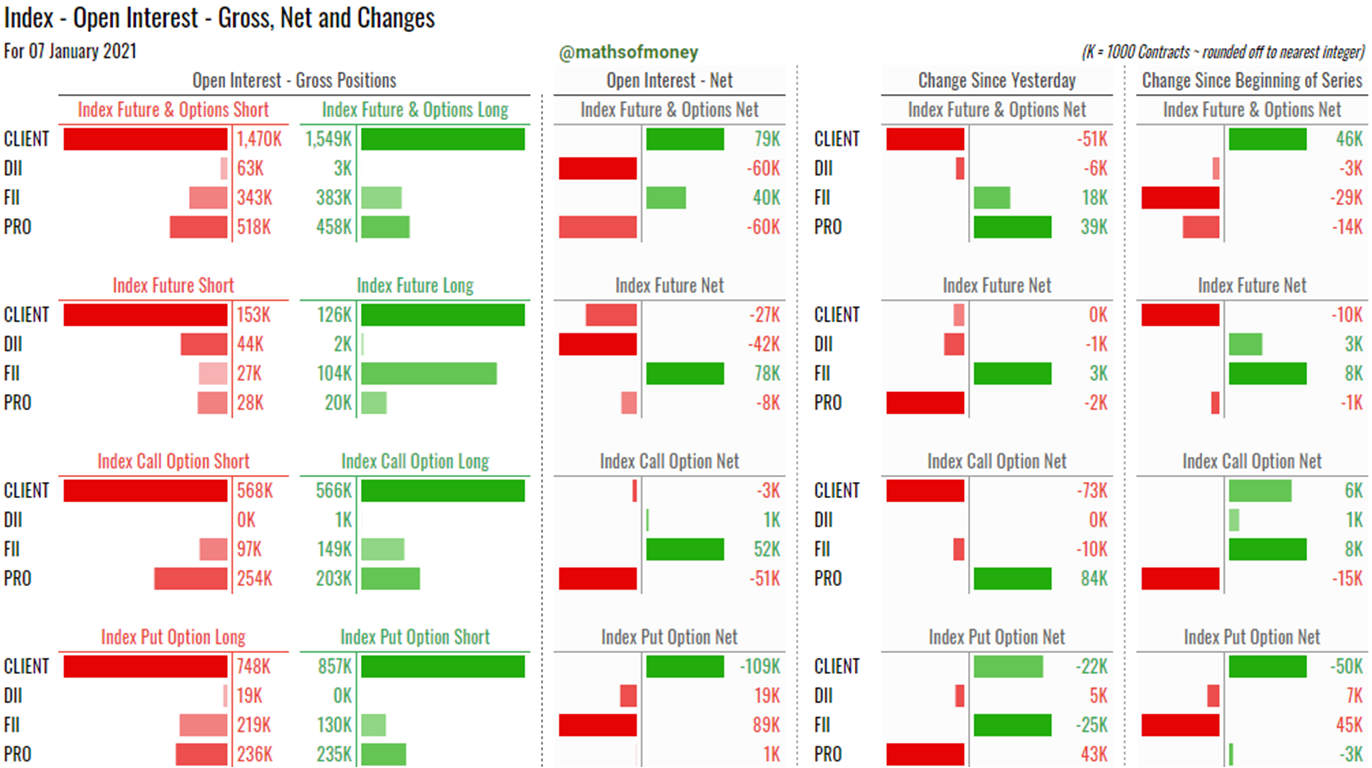

Today's Participant Wise Open Interest - Index Charts

[NEW REPRESENTATION - INCLUDING GROSS OPEN INTEREST NUMBERS]

Today's Participant Wise Open Interest - Stock Charts

[NEW REPRESENTATION - INCLUDING GROSS OPEN INTEREST NUMBERS]

Now let us discuss this numbers in detail.

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- There was little to no participation in index futures today by any of the participants and the whole action was focused primarily on option trades - quite understandably so considering today was weekly expiry and we saw huge built up in clients positions just yesterday.

- Clients have unwound 51k long in index today by booking profits in 73k index call options and by writing new 22k index put options.

- Interestingly, with today's addition in net index put writing (22k), clients now carry net short in index put options of 109k contracts. This is their open interest after weekly expiry and hence means they are playing for Nifty and Bank Nifty TO NOT FALL at least till next weekly expiry - assuming these shorts in index puts are of only next week.

- Additionally, on Index gross levels (NEW REPRESENTATION - INDEX CHARTS) it draws attention that clients (retail investors) carry highest open interest in Index Futures (Long and Short), Index Call Options (Long and Short), Index Put Options (Long and Short). The second highest open interest by any of the rest of the participants are not even worth mentioning. These level participation, especially towards writing of index call options and index put options mean that the market is gearing up for sharp moves in either direction.

- The gross open interest numbers for stocks (NEW REPRESENTATION - STOCK CHARTS) show that Pro have almost matched up with Clients in buying stock put options and selling stock call options - both bear play. However, clients are uncontested kings in stock options bull play - buying of stock call options and selling of stock put options.

- The only respite which is keeping market up with stocks rotating is stock futures open interest where FII is close second in stock futures long and clients are nowhere to be found on stock shorters.

- This conclusively disproves the common belief - THE MARKET IS NOT FALLING BECAUSE RETAIL IS SHORT. Retail is not short where it matters yet and FII still has 680k stock futures long to distribute before the market can start seeing red.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII have added net shorts in both Index and Stocks.

- Its important to notice that at gross levels, DII's open interest is extremely low across all instruments, however, just because all their open interest is simply towards short side, they end up being the top net shorters of index. This to conclude that DII has no trade in index, its purely hedging play.

- At gross levels, even stocks open interest shows that same story for DII. Even with near about shorts held by FII and Clients, the net short by DII towers over all the rest - again the same conclusion - no trade just hedge.

- Now let us compare DII's cash market number for the day with the hedge we are seeing. Today DII are net sellers of 989 Crs. This should mean that they must reduce their hedge for these positions. However, they have added the hedge - means they simply increased the hedged proportion of their portfolio.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Taking advantage of today's both sides movement, FII have booked profit in some of their index call options and put options for today effectively increasing their longs in index by 25k contracts while their net open interest change in stocks was minuscule.

- Gross open interest numbers reflect that FII have very thin interest in index (almost all instruments) and even in stock call options and put options. However, the are keenly interested in stock futures.

- Assuming that their long and short positions are in different stocks, FII has highest short position in stock futures (excluding DII's hedge) with 521k contracts. Also, their second highest and almost equal to retail investors longs in stock futures (680k) is something thats keeping the market ticking and the number we must keep a keen eye on.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro have covered their entire short in index put options (43) today and some portion of their shorts in index call options (84k) as well resulting in net reduction of 39k shorts in index. However, they still carry net short of 60k in index.

- With continued call writing in stocks for the day (7k), Pro have increased their net short (8k) in stocks to 118k contracts which includes 142k net call writing.

- At gross levels, they do carry 178k longs in stock futures. This also might see distribution going forward or further increase in net put longs to cover stock futures long completely.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY :

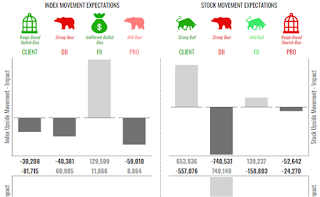

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients are now THE ONLY LOSERS in case index falls and they do not gain anything if index rises

- FII have taken full advantage of two sided movement in index today and continue to be fully hedged against any fall in index

- DII continue their hedge bets - remain strong bears by standing to gain the most in case of fall

- PRO have now officially joined DII as bears

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients stand to gain the most in case of rise in stock prices and also to lose the most in case of fall

- FII are second in bull race with risk reward almost matching

- PRO are expecting to keep stocks within the range and to break down rather than to break out

Please feel free to leave your comments and follow on Twitter in case you want to know more about Participant Wise Interest Interest Analysis.

Comments

Post a Comment