Participant Wise Open Interest || 12th Jan Analysis of FII DII CLIENT AND PRO Data || Nifty OI, Bank Nifty OI, Change in Nifty OI

Participant Wise Open Interest Analysis based on Today's FII, DII, Client and Pro Data

Welcome to the analysis of FII, DII, Client and PRO data of their open interest in Index Derivatives (net open interest and daily changes in Nifty Open Interest and Bank Nifty OI) and Stock Derivatives (net open interest and daily changes in Stock Futures, Stock Call Options and Stock Put Options).Sections of this analysis:

- Macro and global factors

- Participant wise open interest data

- Clients open interest data

- DII open interest data

- FII open interest data

- PRO open interest data

- Open interest data converted into EXPOSURE TO VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to INDEX VOLATILITY

- FII, DII, Clients and PRO Data - Exposure to STOCK VOLATILITY

1. Macro And Global Factors

Before we proceed with today's open interest data analysis, let us understand few global / macro factors which are more relevant for NSE / BSE these days:

- India VIX: Remained at or above 23 for better part of the day and contracted slightly to close at 22.85 with firm increase in Nifty. This definitely means that counter bets are now increasing and are priced in option premium. This is a growing concern for bull case for Indices.

- Dollar Index: DXY remained flat at 90.40. May be traders and investors are still waiting for one final clue before the taking big bets in USD could that could be reading something between the lines of fed commentary or something to do with transition of power, only time will tell.

- Oil: Resumed upward journey with 1-2% gain for the day. Oil prices are here to rise, let us wait for this adjustment to reflect in key stocks heavily dependent on Oil either as raw material (negative) or as commodity (positive).

- Daily RSI: Nifty's resilience is very much evident with daily RSI reaching 81. Officially Nifty is OVERBOUGHT and needs to consolidate or correct immediately - also weekly expiry is just two days ahead, may be we can see some sharp returns on PE side or call writing. Bank nifty still has a lot of upward room left as per daily RSI the price action today also showed the same story.

2. Participant wise open interest data

Previous Day's FII, DII, Client and Pro Data || Open Interest Analysis

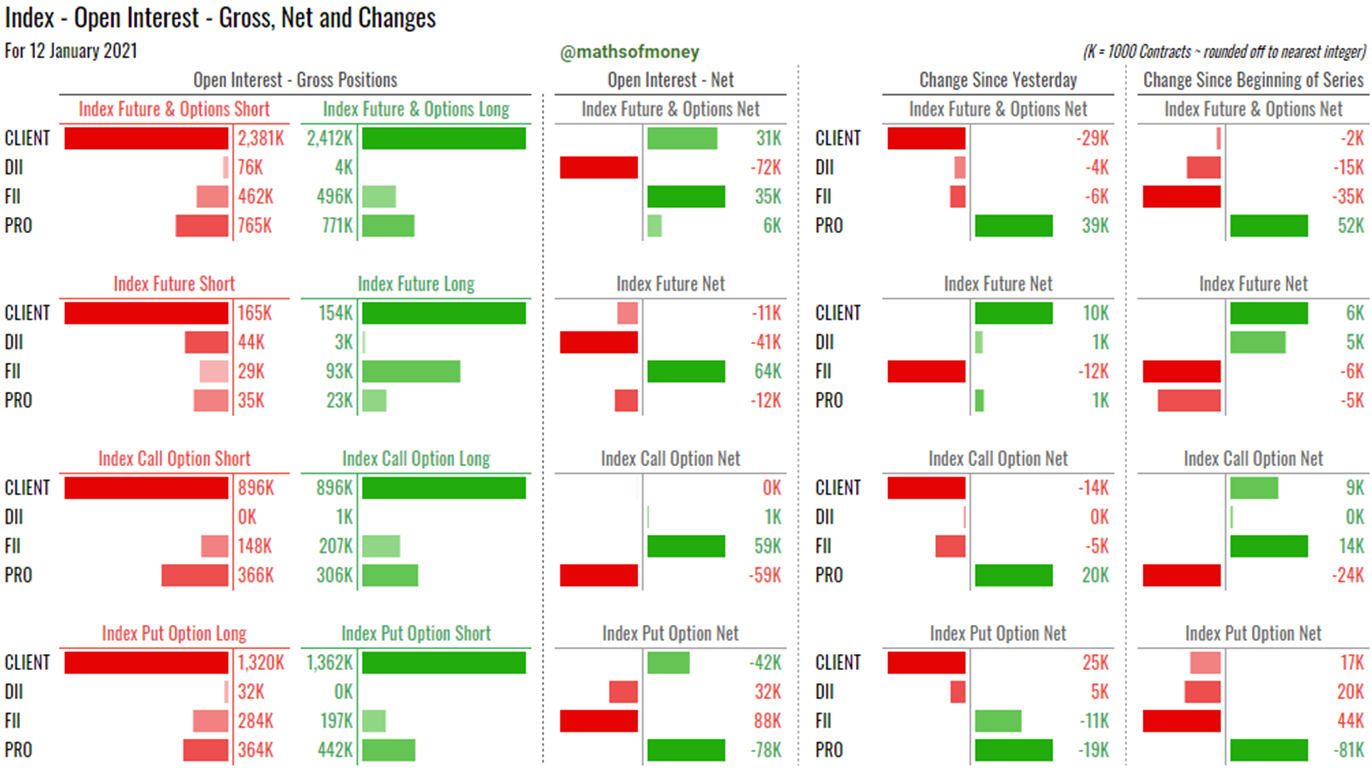

Today's Participant Wise Open Interest - Index Charts

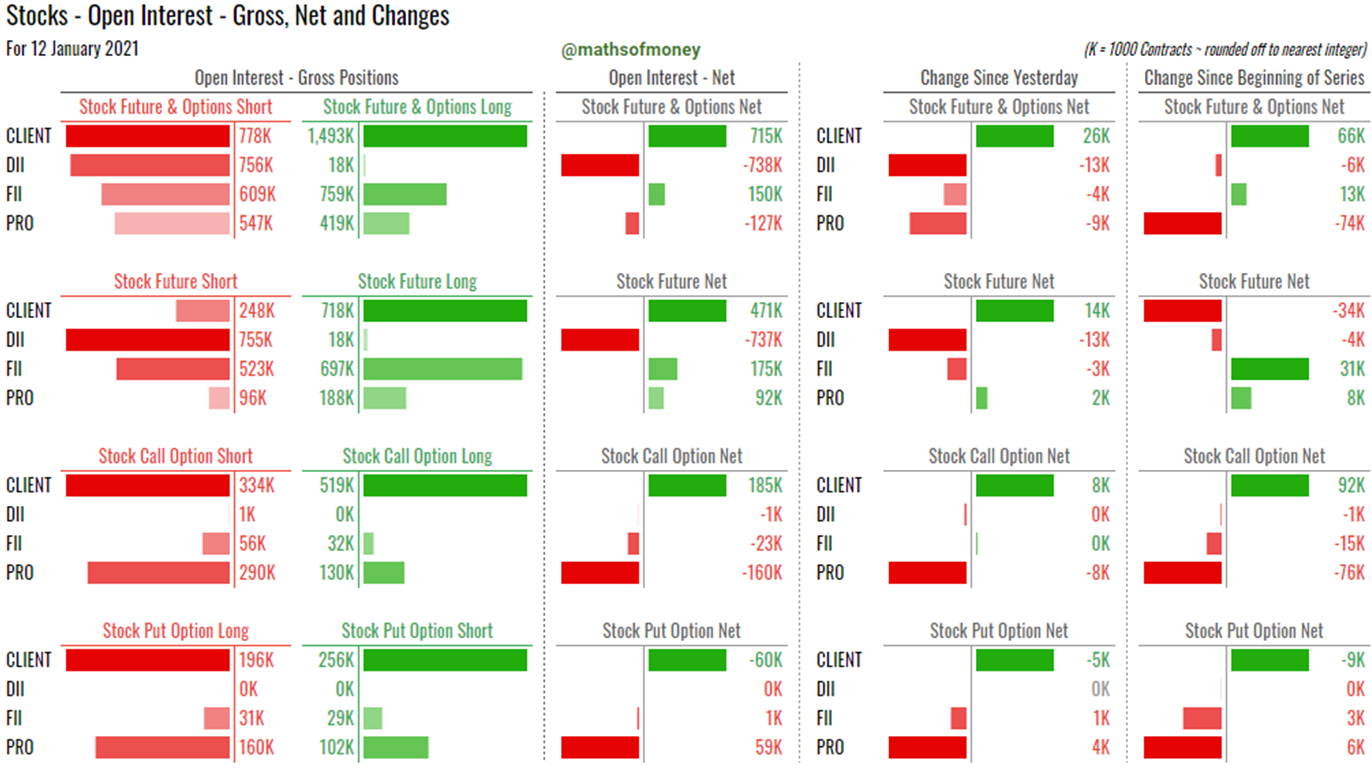

Today's Participant Wise Open Interest - Stock Charts

3. Clients Open Interest Data:

(How Clients participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- Contrary to common belief, clients keep playing smart and booking gains. Today clients have booked profit on 29k longs in Indices which were created over last two days.

- Now clients have almost nil net open interest in index call options (with call buy and sell almost matching) however, gross open interest remains at almost 900k contracts.

- Similar set up is seen on gross levels of index put options with clients now carrying more than 1.3 million open interest in index put option buy side and sell side each. Other participants put together do not reach even half of this open interest.

- This kind of participation by clients in index options is unprecedented and simply speaking makes any movement in VIX extremely relevant for their open interest as VIX is the product of premium pricing for index options. Coincidentally India VIX is also bordering the trend reversal level of 24. So key take away is, for any index trades keep a very strict stop loss because if trend reverses with this level of data it is going to be sharp and ugly, either side.

- Clients are the only longs (26k) in stocks today and they continue they hussle with Pro for stock call options:

- Clients sold additional 5k stock put options to pro today taking the total to 60k now

- Pro sold additional 8k stock call options to clients today taking the total to 160k now

- So far clients have emerged winners of this battle over last few days though.

4. DII Open Interest Data:

(How DII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives)

- DII had a very dull day in indices today with adding 4k net shorts to their hedged open interest tally, however, stock side had some movement with 13k shorts added for the day this is in spite of selling 1300 crs of stock in cash market for the day. So increased proportion of their hedge.

5. FII Open Interest Data:

(How FII participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- FII have brought their gross long in index futures to less than 100k today by unwinding 12k longs. As discussed yesterday, this is an important pillar supporting market's upward journey. Any significant reduction in this number can be taken as undisputed indication of market getting ready to FALL (not just "CORRECT").

- In spite of this, FII remain the only participants who are net buyers of index futures (64k) and carry a peculiar dial with Pro for net index call options (59k bought from pro).

- And FII continuing to be the largest net long in index put options by 88k contracts also indicates that PREMIUM OF INDEX PUT IS AN INVESTMENT AND NOT A COST.

- With muted net change in stock open interest, FII continue to hold their 700k long in stock futures and this is something bulls would want to keep a close eye on as the second pillar supporting the market.

6. PRO Open Interest Data:

(How PRO participated in Nifty Open Interest, Bank Nifty Open Interest and Stock Derivatives):

- Pro, it seems, were pushed by clients to cover their short and book losses in index call options (20k), however they still remain the only net sellers of index call options (59k) to FII.

- With options being expensive, Pro continue to concentrate on writing and have written additional 19k index put options taking their net short in index put options to 78k which is a tussle with FII directly.

- Pro are engaged in similar tussle with clients on stock options front and even though Pro have slim open interest in rest of the instruments, they are building up open interest fast in stock put options to catch up to clients.

7. Open Interest Data converted in "Exposure to Volatility"

(Risk exposure for each participant - Client, FII, DII and Pro in case of sharp movement in Index and Stocks in either direction):

- Long positions can be created by Buying of Call Options or by Selling of Put Options. Even though both are longs, the risk reward to participant are extremely different.

- CALL BUYERS take risk equal to premium paid and shall only lose the premium amount in case of downward movement. However they participate and earn fully in case of upwards movement of the underlying asset.

- On the other hand, PUT SELLERS earn only the premium amount and nothing more in case of upwards movement however they take unlimited risk and loss in case the underlying moves downward.

- Therefore, it is not sufficient to only analyse NET LONG or NET SHORT positions but also to consider the nature of this position which shall reveal more details like which participants shall look to buy in case of dip (may be to protect their shorts in put options) and which shall look to sell in case of rise (may be the participant with highest short in call options).

- To account for this, we have mapped each participants open interest data with the nature of open interest and converted it into their EXPOSURE TO VOLATILITY in Index and in Stocks.

- Here is FII, DII, CLIENTS AND PRO DATA summarizing their EXPOSURE TO VOLATILITY:

8. FII, DII, Clients and PRO - Exposure to Index Volatility

(Nifty Open Interest and Bank Nifty Open interest including Futures, Call Options and Put Options)

- Clients remain trapped on index front with losses in case of sharp movement either side

- DII are hedged smartly and happen to lose half in case indices go up and earn double in case indices fall.

- Even though FII are fully hedged against any fall in indices, their best interest still lies in keeping the market up

- Pro are set to keep indices contained at least till weekly expiry and then will know how their open interest built up changes for further direction in indices.

9. FII, DII, Clients and PRO - Exposure to Stocks Volatility

(Stocks Open Interest covering Stock Futures, Stock Call Options and Stock Put Options)

- Clients do carry naked longs in stock futures. This tells us that rotation will continue.

- In spite of having most of their longs covered, the stock futures long of 700k is still the only thing keeping bears at bay.

- DII remain largest shorts in stocks which is dismissed as hedge.

- Pro even though are looking to keep stocks also contained, they have an interesting hussle going on with clients on stock options front.

Follow @mathsofmoney

Comments

Post a Comment